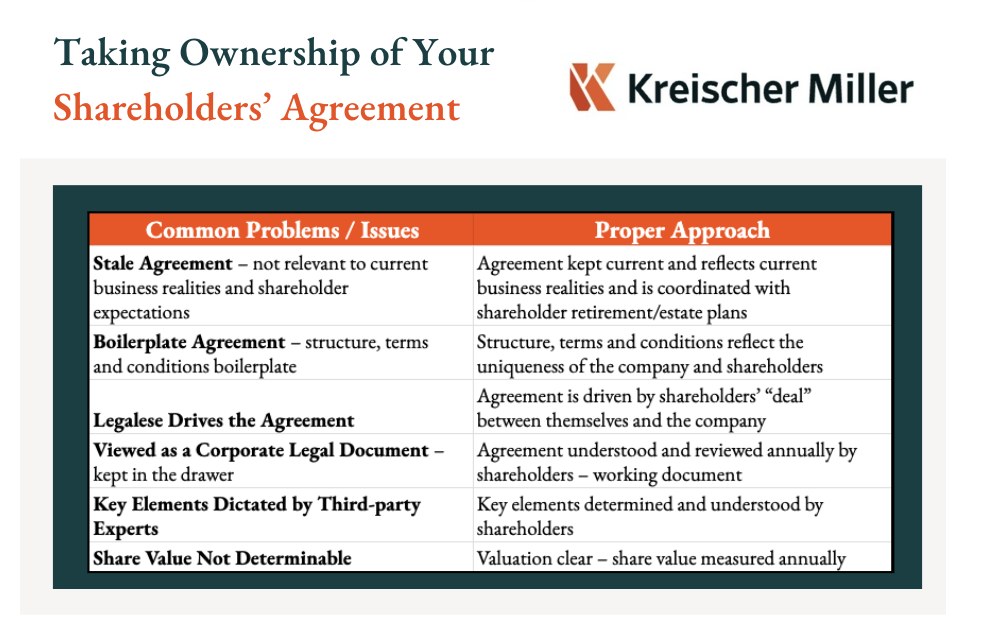

A well-crafted shareholders' agreement (SHA) can act like a partnership agreement — helping a company operate smoothly and ensuring that shareholders' interests are protected. Unfortunately, many agreements fall short by quickly becoming outdated, being altogether too generic, or failing to reflect the true intentions and needs of the shareholders.

That’s why we decided to explore common pitfalls that can undermine the effectiveness of a shareholders' agreement — such as stale agreements, boilerplate terms, and legalese-driven documents.

By understanding these issues, companies can ensure their agreements remain relevant, practical, and aligned with both the business's evolution and the SHA’s goals. Here are six common problems we see with shareholders’ or partnership agreements:

1. The agreement is outdated.

Problem: A shareholders' agreement that isn’t regularly updated can become irrelevant to the company’s current realities and shareholder expectations.

Solution: The agreement must be regularly reviewed and revised to align with the company’s evolving business realities and to coordinate with shareholders’ retirement and estate planning. This ensures the agreement remains a useful tool rather than a forgotten relic. Schedule periodic reviews, at least annually, to update the agreement so it reflects the company’s evolving business environment and coordinates with shareholders' retirement and estate plans.

2. It’s a copy-and-paste “boilerplate” agreement.

Problem: Using a generic, one-size-fits-all boilerplate shareholders' agreement is a major mistake. These broad-stroke formatted documents can — and often do — overlook the unique characteristics and needs of your company and its shareholders. Oftentimes, this means it was never designed to reflect your long-term plans to begin with.

Solution: An agreement tailored to your business and the personal circumstances of your shareholders will better serve all parties, ensuring that terms and conditions are relevant and meaningful. Customize the agreement to reflect the unique structure, goals, and relationships within the company. Involving shareholders and legal experts in drafting a tailored agreement helps ensure that all specific circumstances are considered.

3. The legal team buries the lede or hides the intents inside the agreement.

Problem: If the agreement is overly complicated with legal jargon, it can become more about the legal language than the actual business arrangement between the shareholders.

Solution: Ensure the agreement is written in language everyone can understand so that it simply outlines the shareholders’ relationship with the company. Involving all parties in drafting the agreement and using plainly worded sentences that follow Flesch's reading ease can help keep the focus on the business arrangement rather than the legal formalities.

4. The agreement is only considered a “corporate ask.”

Problem: An agreement that is seen merely as a formal document to be filed away cannot be practically useful. Instead, the shareholders' agreement should be a living document, regularly reviewed and understood by all shareholders.

Solution: Treat the shareholders' agreement as a living document that is regularly reviewed and understood by all shareholders. By making it a working document and discussing it annually, shareholders stay aligned and prepared for any eventualities.

5. Key elements of the agreement are dictated by third-parties — not those actually involved.

Problem: When third-party experts dictate the key elements of the agreement without input from the shareholders, the document might not fully reflect the shareholders’ intentions or understanding.

Solution: Engage shareholders in determining and understanding the key elements of the agreement, ensuring their intentions are accurately reflected. Collaboration between shareholders and legal advisors helps create a balanced document that all parties understand and agree on.

6. The share value is not determinable.

Problem: An unclear or outdated method for determining share value can lead to disputes and uncertainty, especially when a shareholder wants to exit or transfer their shares.

Solution: Establish a clear and agreed-upon valuation process, with share values measured annually. Regularly updating the valuation ensures transparency and fairness, minimizing potential conflicts and making the process smoother for all involved.

Next Steps to Ensure Your Shareholders’ Agreement is Effective and Up-to-Date

Crafting a comprehensive shareholders' agreement is a critical step in safeguarding the interests of both Crafting a comprehensive shareholders' agreement is a critical step in safeguarding the interests of both the company and its shareholders.

We discuss these common problems with shareholder agreements and more in our webinar — Shareholders' Agreements: the Good, the Bad, and the Ugly. Click here to download the slides from the webinar and to learn more about:

- Shareholder agreement risks and critical elements to include

- Considerations from a tax perspective

- What works and does not work in relation to shareholder agreements

To discuss this topic in further detail, please contact Brian Kitchen, Director, Tax Strategies or Thomas Yankanich, Director, Audit & Accounting.