After years of waiting, Financial Accounting Standards Board (FASB) Accounting Standards Update (ASU) 2016-13, Financial Instruments – Credit Losses (Topic 326), Measurement of Credit Losses on Financial Instruments, as amended, is effective in 2023 for private companies that operate on a calendar year. The ASU introduces the current expected credit loss (CECL) model, which consolidates most of the impairment guidance under prior U.S. GAAP into one comprehensive standard.

What is different about CECL?

Prior to the adoption of the new guidance, legacy U.S. GAAP provided for recognition of impairment and losses under an incurred loss model which generally required the loss to be probable before the credit loss would be recognized. Under the new guidance, the probable threshold is removed, and credit losses should be recognized based on the current expected credit losses without regard to the probability of the loss occurring. This differential results in an acceleration of the analysis and recognition of expected credit losses to begin as soon as a financial asset is recorded.

Does the CECL model apply to my business?

Most likely. The CECL model applies to most financial assets which are measured at amortized cost. While banks and other financial institutions are obvious holders of financial assets, the term financial asset is broad in scope and includes:

- Financing receivables (loans)

- Held-to-maturity debt securities

- Trade receivables and other contract assets

- Certain off-balance sheet credit exposures not accounted for as insurance (e.g., loan commitments, standby letters of credit, financial guarantees)

How do I calculate losses under the CECL model?

The CECL standard provides an overarching model to recognize credit losses but does not mandate a specific methodology to calculate such credit loss. This leaves significant room for management estimates and judgment.

The CECL model does provide that an entity’s estimates of expected credit losses should reflect losses over the contractual life of the financial asset. The measurement of these credit losses can be complex and generally requires management to consider 1) financial asset pooling, 2) historical data, current conditions, and forecasts, and 3) estimation method.

- Financial asset pooling – Entities are required to pool financial assets with similar risk characteristics and measure credit losses separately for each homogenous pool of assets. These pools may require continued reassessment as risk characteristics change. The number of required pools will vary based on the nature of the entity and its financial assets. While not an exhaustive list, common characteristics for asset pooling (especially for common trade receivables) include:

- Financial asset type

- Industry or geographic location of the borrower

- Credit rating of the borrower

- Age or term of financial asset

- Collateral type

If an individual asset has significant credit deterioration or other risk characteristics, it should be removed from the pool and individually assessed.

- Historical Data, Current Conditions, and Forecasts – The starting point for expected future losses is based on historical data which may come from internal or external sources. Historical loss experience is generally the baseline for estimating expected credit losses for each pool. From this, the historical loss experience should be adjusted for pool- or asset-specific risk characteristics. Management should then evaluate how current conditions and reasonable and supportable forecasts differ from the conditions in which the historical losses were incurred, and provide adjustments to the historical rates based on this information.

In making determinations of how conditions differ from when loss rates were incurred, sample risk factors include:- General economic conditions such as inflation rate and unemployment rates

- Interest rates

- Payment status/structure

- Local economic market conditions

- Collateral valuations

- Estimation Method – The CECL model provides management the ability to use judgment and various estimation techniques to apply the CECL model for its financial assets. The specific model chosen will largely depend on the type of financial asset being assessed. Common models used to estimate credit losses under ASC 326 include:

- An aging schedule

- Roll-rate/loss-rate methods

- Probability of default method

- Discounted cash flow method

Many private companies are familiar with utilizing an aging schedule or the loss-rate/roll-rate method. These are still viable options for trade receivables, subject to additional assessment factors related to asset pooling and market conditions/expectations, as required under the CECL model.

How does CECL look in practice?

Assume you operate a consulting business and your primary customers are software companies. Based on the business, it is determined that the customer receivables can be broken into two asset pools: start-up companies and multinational corporations. Further, in evaluating historic loss ratios, you determine that historical losses for start-up companies are correlated to the prevailing interest rates (due to the leveraged nature of these businesses).

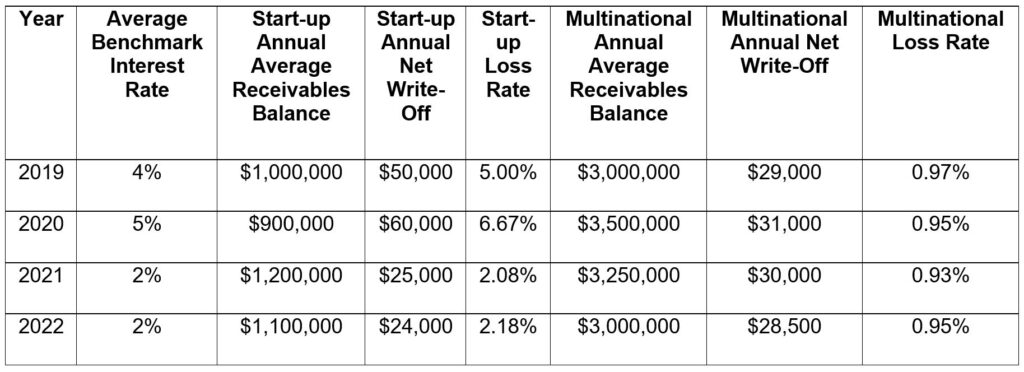

Based on the fact pattern, it is determined that the loss-rate method is the most accurate and relevant estimation technique. Historical loss rates for each risk pool and applicable market conditions are as follows:

On December 31, 2023, you evaluated the outstanding benchmark rate to be five percent. After reviewing economic data from the Federal Reserve, you have supportable and forecastable reason to believe that this rate will continue, if not slightly increase for the term of the related receivables.

Further, on December 31, 2023, outstanding receivables for start-up companies and multinational companies are $1,000,000 and $3,500,000, respectively. Because the multinational loss rate has not historically been affected by interest rates, a loss rate of 0.95 percent, or $33,250, is calculated under the model for this asset specific pool. Because the start-up loss rate has been heavily correlated to historic interest rates, it is reasonable to adjust average historical losses to the 6.67 percent loss experience based on current economic rates of five percent (and reasonable and supportable forecasts), resulting in a calculated current expected credit loss of $66,700.

Combined, the overall current expected credit loss under this model on December 31, 2023 is $99,950.

Where do I need to focus my efforts?

Besides learning that CECL applies to most businesses, the biggest obstacle to private company implementations surrounds lack of data and documentation. Historical data is required to determine relevant historical loss factors and the risk characteristics that existed at the time of the loss. Management should begin accumulating such data and document its considerations surrounding the drivers of prior losses. Additionally, management should document its assessment of current and future conditions, and how the assessment correlates to its calculations under the CECL model.

While the magnitude of estimated losses under CECL may not vary significantly from legacy GAAP, the timing of recording estimated losses is likely to be accelerated, from once the loss was probable under legacy GAAP to the time the asset recorded under CECL. In addition, documentation of asset pooling and management’s assessment of historical, current, and future conditions will be more robust.

If you have any questions and would like to discuss CECL and its potential impact on your organization, please contact your Kreischer Miller relationship professional.