When you are planning to merge two companies or acquire another organization, the quality of your due diligence will largely impact the effectiveness of joining the two entities.

Due diligence can include many factors such as financial documents, intellectual property, corporate records, market position, liabilities, and sales. These factors generally fall into one of three categories: commercial, legal, or financial.

However, there is one key due diligence factor that is often overlooked or only evaluated at a very top level: a company’s people and its culture.

Why People & Company Culture Are Important to Consider in Mergers & Acquisitions

One idea that‘s been crystallized after the COVID pandemic — and resulting rising inflation and the Great Resignation — is that people (employees) are the core of your business. This is no different in a corporate merger and acquisition (M&A) situation unless you are buying a company strictly for its market position or customers and have no intention of retaining its talent.

Considering employees and a company's culture during a merger and acquisition is crucial because it helps ensure a smooth integration process and minimizes disruptions. Addressing cultural differences and employee concerns can enhance cooperation and morale, reducing the risk of talent loss and resistance.

Ultimately, aligning organizational cultures and valuing employees fosters a unified, productive work environment, which is essential for the long-term success of the merged entity. That’s why we’re outlining a few ways to help maintain the people and company culture during the M&A process.

Considerations for Preserving People & Culture in a Business M&A

Here are five factors you should consider when conducting people and culture due diligence in the leadup to a corporate merger and acquisition:

1. What are the core values and missions of the company you are acquiring?

This can be discerned through conversations and interviews with leadership, but it can also be confirmed with high-performing team members. Take special note if the answers you receive from leadership do not align with the answers you receive from top performers.

Don’t simply notate this information, think thoughtfully about how the core values of the company you’re acquiring align with your company’s core values. Consider sharing your current core values with newly acquired employees and workshopping ways they differ and align to find a middle ground. Or, if shifting completely to your current venture’s core values, point out existing crossover to ease the transition. As you will see with our follow-up point below, there are many steps you can take to ensure this process goes smoothly.

To preserve the original mission and core values of the company being acquired during a merger, consider the following:

- Conduct Thorough Due Diligence. Understand the core mission and values of the acquired company in-depth through detailed research and discussions with their leadership team.

- Facilitate Open Communication. Engage in transparent communication with employees and stakeholders of the acquired company to convey your commitment to preserving their mission.

- Form a Mission Integration Team. Form a dedicated team comprising members from both companies to oversee the integration process, ensuring the original mission is respected and aligned with the new organizational goals.

- Incorporate the Mission into Strategic Planning: Integrate key elements of the acquired company’s mission into the strategic planning and decision-making processes of the merged entity.

- Conduct Cultural Sensitivity Training: Provide training for employees and management to understand and value the acquired company’s mission, promoting a culture of respect and continuity.

- Monitor Changes and Seek Feedback. Continuously monitor the integration process and solicit feedback to ensure that the mission of the acquired company is being upheld and that any necessary adjustments are made promptly.

2. What are the acquired company’s employees’ informal norms?

A written mission statement is important but the team’s day-to-day reality is what can make or break a culture. When acquiring a company, it is essential to recognize and respect not only their formal core values and mission statement but also their informal values and unique ways of working.

For example, if the acquired company has an informal practice where employees regularly hold impromptu brainstorming sessions in communal spaces, this behavior significantly influences their creativity and collaboration. To suddenly tell them they can’t operate that way anymore is sure to be frustrating and affect their teamwork.

To ensure a smooth and successful integration, actively engage with employees through open dialogues, surveys, and focus groups to understand such informal practices.

By acknowledging and incorporating these insights, you can create a cohesive, respectful, and synergistic environment that honors the strengths and traditions of both companies, fostering a unified culture that drives mutual success.

3. What promises were made to employees and can you still keep them?

If you intend to retain much of the team you are acquiring it is important to know their expectations. This pertains to the merger, of course, but going as far back as promises made in the hiring process can be just as critical.

Areas you’ll particularly want to explore include compensation, promotions, and benefits. For example, if an employee was promised by a past manager a promotion within six months, you want to ensure this promise was not lost in translation during a merger as this could erode the employee’s trust and lead to their resignation.

That said, just because promises were made in the past does not mean that you have to keep them. With new ownership of the company comes new promises, but you’d be remiss not to understand what was initially expected and plan a course for communicating different expectations.

You must be in the position of knowing, not guessing. If you don’t know what promises exist, you won’t be able to explain why certain decisions may change the promises made by previous leadership.

4. Who is on the team? Do you understand how they operate and their needs?

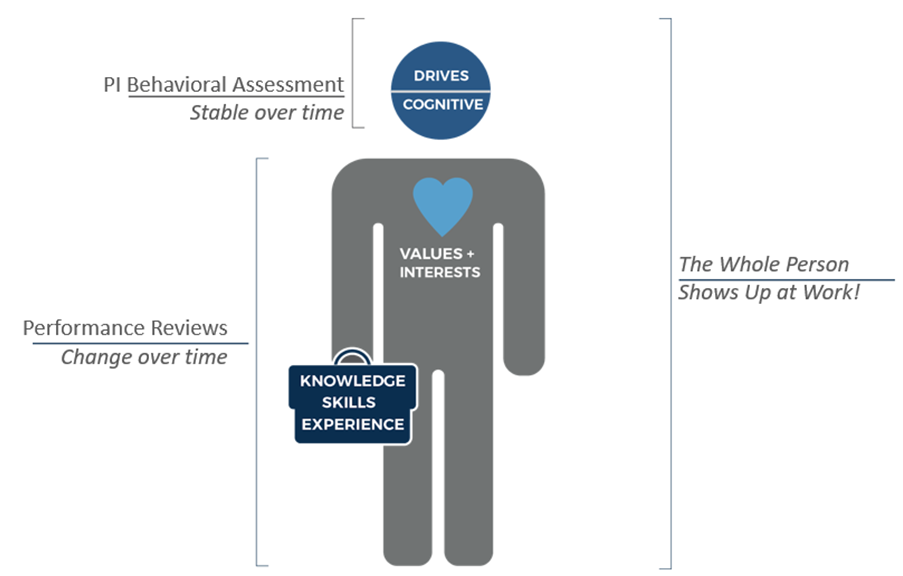

As shown in the diagram below from the Predictive Index, we often evaluate talent through an individual’s “briefcase” or their Knowledge, Skills, and Experience.

This helps us answer questions such as:

- What do they know?

- Where did they go to school?

- How many years of experience do they have?

Sometimes we also evaluate their Values and Interests (the “heart” in the diagram). But we often skip how they are Hard-wired (the “head”) — which can create some gaps in a business M&A transition.

It is important to understand what drives the individuals both in the acquiring organization and the acquired. An acquisition is a big change for all parties involved and represents a unique opportunity for leadership to ensure they have the right people in the right seats to maximize their investment. Take the Predictive Index Behavioral Assessment here to learn more about the process.

5. What are the team dynamics?

As previously mentioned, a merger or acquisition is an opportunity to step back and evaluate what is working and what isn’t. As you join these two organizations together, it is important to understand the dynamics between individuals.

Let's consider the merger of two companies: Tech Innovators Inc. (a technology firm) and Creative Solutions Ltd. (a marketing agency).*

Cultural Integration and Employee Morale

Tech Innovators Inc. has a highly structured, formal work culture with an emphasis on hierarchical decision-making. In contrast, Creative Solutions Ltd. operates with a more flexible, informal culture that encourages creativity and open communication. Understanding these team dynamics is crucial to prevent cultural clashes. The management team can implement integration workshops and team-building activities that blend the structured approach of Tech Innovators with the creative openness of Creative Solutions. This helps in creating a hybrid culture that respects and incorporates elements from both companies, ensuring that employees feel valued and understood, thereby maintaining morale.

Effective Communication and Leadership Transition

During the merger, employees at Creative Solutions might feel overwhelmed by the more formal communication style and hierarchical structure of Tech Innovators. Understanding this dynamic allows the newly formed leadership team to tailor their communication strategies. For instance, they can introduce regular town hall meetings and feedback sessions that combine formal announcements with open forums for creative input. Additionally, leadership roles can be reassigned thoughtfully. A respected leader from Creative Solutions could be placed in charge of a major project, ensuring continuity and trust, while a senior manager from Tech Innovators can oversee operations to bring in structured processes. This balance helps in smoothing leadership transitions and effective communication, ensuring that both teams work cohesively towards common goals.

By understanding and addressing the specific team dynamics of Tech Innovators Inc. and Creative Solutions Ltd., management can facilitate a smoother integration process, maintaining employee morale, enhancing communication, and achieving the desired synergies from the merger.

*The example of Tech Innovators Inc. and Creative Solutions Ltd. was a hypothetical scenario to illustrate how understanding team dynamics can facilitate a smoother business merger and acquisition process. This example is not based on a real-life case but, rather, was designed to highlight common challenges and strategies in M&A transactions, demonstrating the importance of addressing cultural integration, employee morale, communication, and leadership transition when understanding team dynamics.

Talent Advisory Services from Kreischer Miller

Giving thoughtful consideration to these factors in your due diligence phase will help you make a smart investment decision, efficiently meld the two organizations together, and avoid costly people issues.

It’s important to note that turnover can cost your company up to one-half to two time times the employee's salary, according to Built It.

Ensuring that you are just as thoughtful about your due diligence around people and culture as you are around finance and risk will be key to your successful transaction.

For more due diligence and cultural preservation advice like this, explore our Talent Advisory services. Or, for assistance in selling your business, see our M&A Transaction Advisory services.

Contact us to learn more today.