When you’re considering selling your company, appropriately determining the value of your business is essential for a prosperous exit.

However, for many small and medium-sized business owners like our clients, the valuation process can feel uncertain or intimidating — considering there are three primary ways privately-held companies use to value a business.

But one widely accepted and useful metric to simplify this process is EBITDA, which stands for “Earnings Before Interest, Taxes, Depreciation, and Amortization.” The EBITDA method offers a high-level picture of your business's financial state, making it easier to understand your potential market value without prolonging the process by digging into every technical detail.

In this article, we’ll break down what EBITDA really means, why it’s a popular metric, and how business valuation firms use it as part of their overall approach. Of course, we’ll cover the important topic of how EBITDA is used to estimate business value. As you plan your next steps in potentially selling your business — from exploring valuation growth opportunities to preparing for an acquisition — knowing how EBITDA works will help you be more prepared.

What Exactly is EBITDA?

EBITDA is a financial metric used to determine a company's core profitability by focusing on earnings generated through operational activities. The big distinction is that EBITDA excludes the effects of financing, accounting, and tax structure. That means it’s essentially the profit a company makes from its operations alone.

Since EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization, it makes sense to talk about each component of the acronym at a high level:

Here’s how it breaks down:

- Earnings (Profits) are the starting point for EBITDA, which captures the net income generated inclusive of all expenses.

- Before Interest means any interest payments made on business loans or debt are excluded, allowing for comparison between companies regardless of debt levels or capitalization structure.

- Taxes are also not considered so we’re only looking at operational income.

- Depreciation and Amortization (D&A) refers to the accounting method of spreading out the cost of assets over the time period they provide benefits. D&A in periods after the initial capital outlay are non-cash and should be excluded

By not adding these external factors, EBITDA focuses on a company's true operational performance and cash-generating ability. This is exactly what potential buyers, investors, and business owners are looking for.

Why Choose EBITDA for Business Valuation Over Other Methods?

Despite there being multiple options for valuing your business when getting ready to sell, EBITDA is often preferred because it normalizes earnings and provides a clear view of profitability.

For small and medium-sized businesses, EBITDA allows for more straightforward comparisons with other companies, even if they have different debt levels, tax rates, or capital expenditures. In addition, EBITDA reflects a company’s ability to generate profits before external factors — such as interest and taxes — can modify the financial bottom line. For buyers and investors interested in the acquisition, this empowers them to compare businesses regardless of their financial structures. It’s a win-win for both parties in the sale.

Calculating EBITDA: An Example of Using the Formula to Value Your Business for Resale

Calculating EBITDA is done using a formula. Oftentimes, it’s easier to understand by walking through an example.

Let’s roleplay with a fictional company called Provisions. Provisions has the following financial details for the year:

- Net Profit: $150,000

- Interest Expense: $10,000

- Taxes: $20,000

- Depreciation: $5,000

- Amortization: $2,000

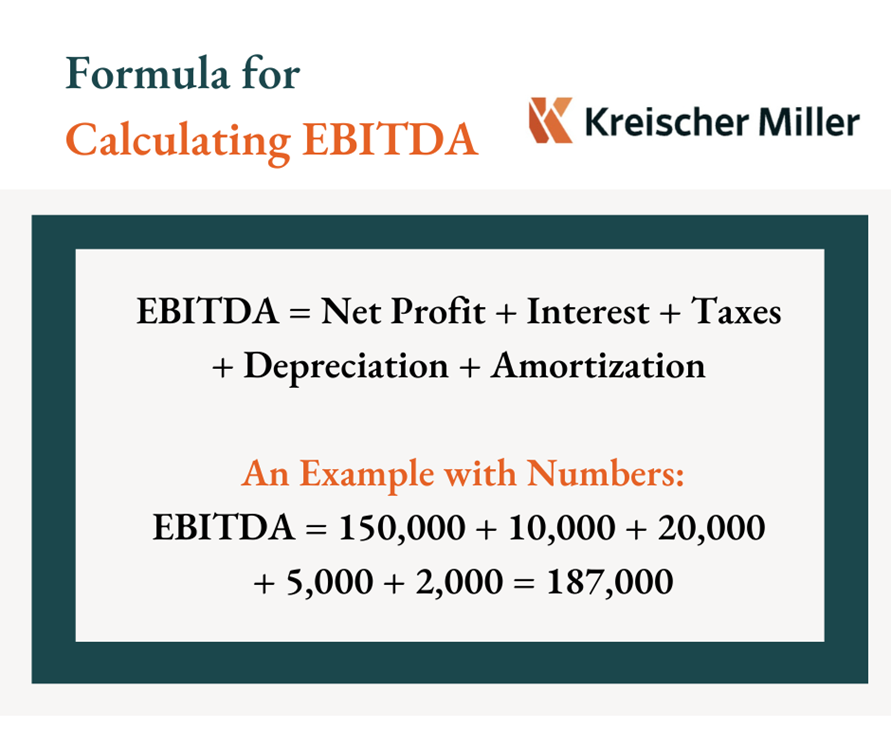

To calculate EBITDA, you’d add back interest, taxes, depreciation, and amortization to the net profit: EBITDA = Net Profit + Interest + Taxes + Depreciation + Amortization. Please see our graphic below for the formula in action.

In this example of using the EBITDA formula, the company’s EBITDA is $187,000. We’re focusing on Provisions’ operational earnings, showing a less variable number that better reflects business performance.

The Role of EBITDA in the Overall Valuation Process

While EBITDA provides a clear picture of operational profitability, it’s not the only number that factors into a comprehensive valuation. Many other aspects of a business — such as future growth potential, market conditions, and industry-specific risks — must be considered to arrive at an accurate and realistic value.

Valuation professionals use EBITDA as one part of a larger picture to determine a business’s value, like revenue multiples, cash flow analysis, and market comparisons.

Business Valuation Services with Kreischer Miller

EBITDA is just one consideration when valuing your business’s worth. The aim of this article is not to turn you into a valuation expert — but to give you a clearer picture of a key factor that valuation firms like ours use when assessing a company’s value.

With this understanding, you can better communicate with professionals and ask the right questions to ensure you’re getting an accurate and realistic appraisal. To obtain a true, fair value of your business, working with a trusted advisor is essential.

Explore our robust Business Valuation Services and reach out to start your business sale journey, today.