Creating an advisory board can be a game-changing step for family businesses looking to enhance their value and secure their long-term legacy. However, many business owners approach this process with uncertainty, either due to a lack of knowledge or because they have heard negative experiences from others.

Despite these concerns, forming an advisory board doesn’t have to be a daunting task. By considering these important items when creating a board, business owners can assemble a team of advisors who will provide valuable guidance and support.

Here are key things to consider when creating a family business advisory board:

1. Defining Purpose & Goals

Before forming an advisory board, business owners should identify their primary objectives. Are they looking to drive business growth, introduce governance, support next generation leaders, or develop a succession plan? Clearly defining measurable goals ensures that the advisory board functions as a strategic asset rather than an informal discussion group.

The role of the family advisory board should be to provide an independent voice on:

- Overseeing or even developing corporate governance

- Monitoring and assisting in the business’s short and long-term strategy on growth, succession, people, opportunities and threats

- Acting as a sounding board and providing advice to management while holding them accountable

- Assisting in the leadership succession

- Supporting other non-executive or inactive family shareholders to ensure their interests are being represented fairly

2. Structuring the Board

Determining the number of members and the balance between family and external advisors is essential. A well-rounded board includes independent professionals who provide fresh perspectives while also incorporating members familiar with family business dynamics.

Choosing a Mix of Family & Non-Family Members

An effective advisory board consists of both family and non-family members.

The family representatives should be individuals who are equipped to deal with governance-related issues. This means having a proper temperament, an understanding of the business, a commitment to being prepared for meetings, and a level of trust from the majority of the family members who will be represented by this individual.

The best non-family board candidates are experienced and knowledgeable outsiders in business or in industry who can remain independent but also be sensitive to the concerns of the family.

Identifying Expertise & Experience Gaps

What knowledge and skills are missing within the current leadership team? The advisory board should complement the company’s strengths and address skill gaps. For instance, if exploring a strategy on integrating artificial intelligence into the business operations is a priority but leadership lacks the knowledge or expertise, seeking advisors with firsthand experience in AI implementation is crucial.

3. Setting Responsibilities and Cadence

All of your family business advisory board members should be held to high standards, similar to those of a corporate board. Establishing formal agreements that outline roles, responsibilities, meeting attendance, and decision-making processes helps ensure accountability and effectiveness. Board members and other stakeholders of the business must be willing to meet frequently enough to gain and maintain momentum and address key issues.

Compensation & Incentives

Deciding whether advisory board members will be compensated is an important step. While some advisors may contribute voluntarily, offering financial compensation or other incentives acknowledges their expertise and encourages commitment. The level of compensation should be meaningful enough to reimburse a board member for the time they take to prepare for meetings and contribute in a meaningful manner.

Establishing Term Limits & Board Renewal

Setting term limits helps keep the advisory board dynamic and relevant. A term of three to five years with an annual review allows advisors to step down if needed while also ensuring that the board benefits from a mix of seasoned and fresh perspectives.

Requiring a Consistent Meeting Agenda

The typical meeting agenda items include:

- Shareholder-related topics such as electing directors, evaluating capital allocation, and weighing in on major transactions

- Family topics such as reviewing succession plans, introducing multigenerational family council initiatives, incorporating family values and vision, and providing next-generation development support

- Board-oriented topics, such as updating strategic plans, reviewing the performance of key executives, and analyzing management’s report on the company’s finances.

4. Ensuring Confidentiality & Building Trust

To foster open discussions and protect business interests, implementing confidentiality agreements is recommended. Business owners should also take steps to build trust by carefully vetting potential advisors and establishing clear communication protocols.

5. Addressing Legal & Governance Considerations

Business owners should establish formal governance structures to define the advisory board’s role and interaction with existing leadership entities, such as the board of directors or family council. This ensures alignment with business goals and regulatory requirements.

The Stages of Family Governance

In the early stages of a family business, the governance process is often handled solely by the founder(s). Governance tends to be informal and delivered via sporadic family meetings. As the business evolves and the second generation begins to assume larger roles, the need for more formality starts to become apparent. Now the dynamic of managing sibling relationships and spouses comes to the surface. Once the third generation and beyond become involved and the family dynamics increase in complexity, the need for an external, independent voice intensifies.

6. Planning for an Exit Strategy

It is important to outline circumstances under which the advisory board may be dissolved or restructured. This could include major business transitions such as a sale, leadership change, or market exit. A flexible plan allows for the integration of new expertise as business needs evolve.

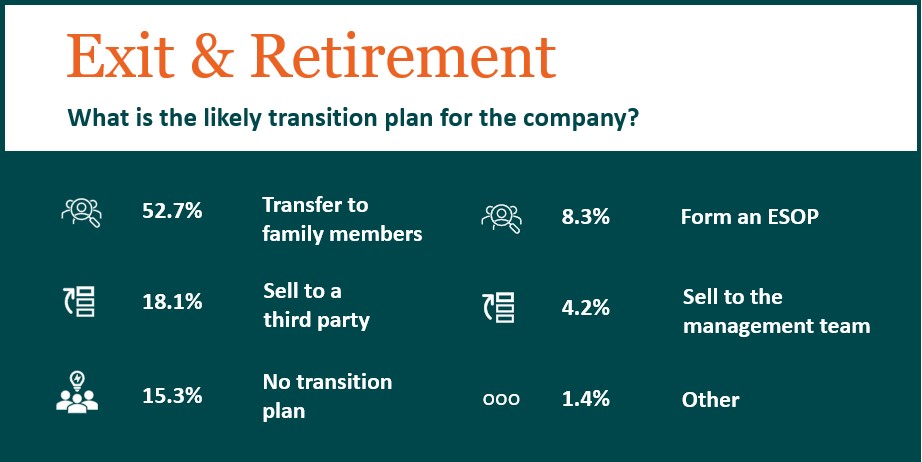

In our most recent Family Business survey, we found that 52.7 percent of those surveyed were planning to transfer their business to another family member when they were ready to leave the business. However, if they were to sell to a third party (as the 18.1 percent would), that would require a much different exit strategy. Therefore, it’s crucial to plan for any number of the following scenarios:

7. Leveraging the Board for Succession Planning

An advisory board can play a pivotal role in mentoring future leaders and ensuring a smooth transition of leadership. Advisors can provide guidance, support, and oversight, helping to develop the next generation of business leaders.

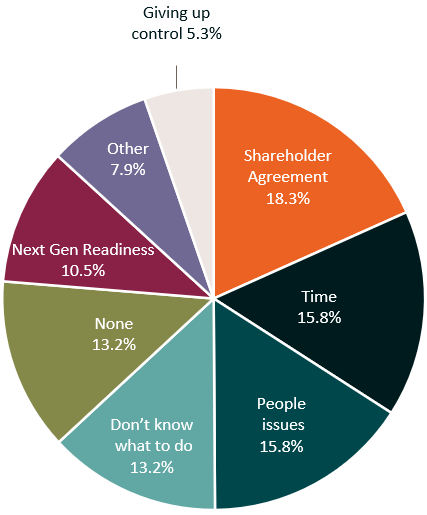

In our most recent Family Business survey, we found that 45.9 percent of respondents indicated that they do not have a management succession plan in place. They revealed that the biggest obstacles in creating one have been the following:

Explore our article, Dos and Don'ts of Creating an Effective Succession Planning Strategy, for actionable tips on planning for a future transition.

Next Steps in Creating Your Family Advisory Board

Forming a family advisory board doesn’t have to be overwhelming, and using the steps above as a guide will help lead you to success. Get started by taking a step back and clearly defining the purpose of the board. Whether it’s to improve corporate governance, address skill gaps, support succession planning, or assist in the integration of new technologies, business owners can tailor the board’s structure to align with specific objectives.

Family-Owned Business Services with Kreischer Miller

The formal development of an advisory board represents the evolution of a family business and is an important tool in implementing effective governance. Because no leader is immortal, having a structure in place like a family advisory board allows for the continuity of leadership and guidance even after the leader is no longer involved in the business.

Forming an advisory board is just one of the many steps to ensure a smooth family business transition. Our team can support in a variety of ways, from exit strategies and transition planning to establishing family business governance. Explore our Family Business Services and please contact us to learn more.