We recently conducted our annual Kreischer Miller Private Company Pulse Survey®. We created this survey because we recognized how critical privately held and family-owned companies are to our region’s economy, job creation, and growth. These companies truly represent the pulse of what is going on in our markets, and we thought it was important to gain insight into what’s on the minds of their owners and executives.

In this article we share the key findings from our 2024 survey, which was conducted in early March.

Key Finding #1: Private companies in the Greater Philadelphia region are expecting solid business results in 2024.

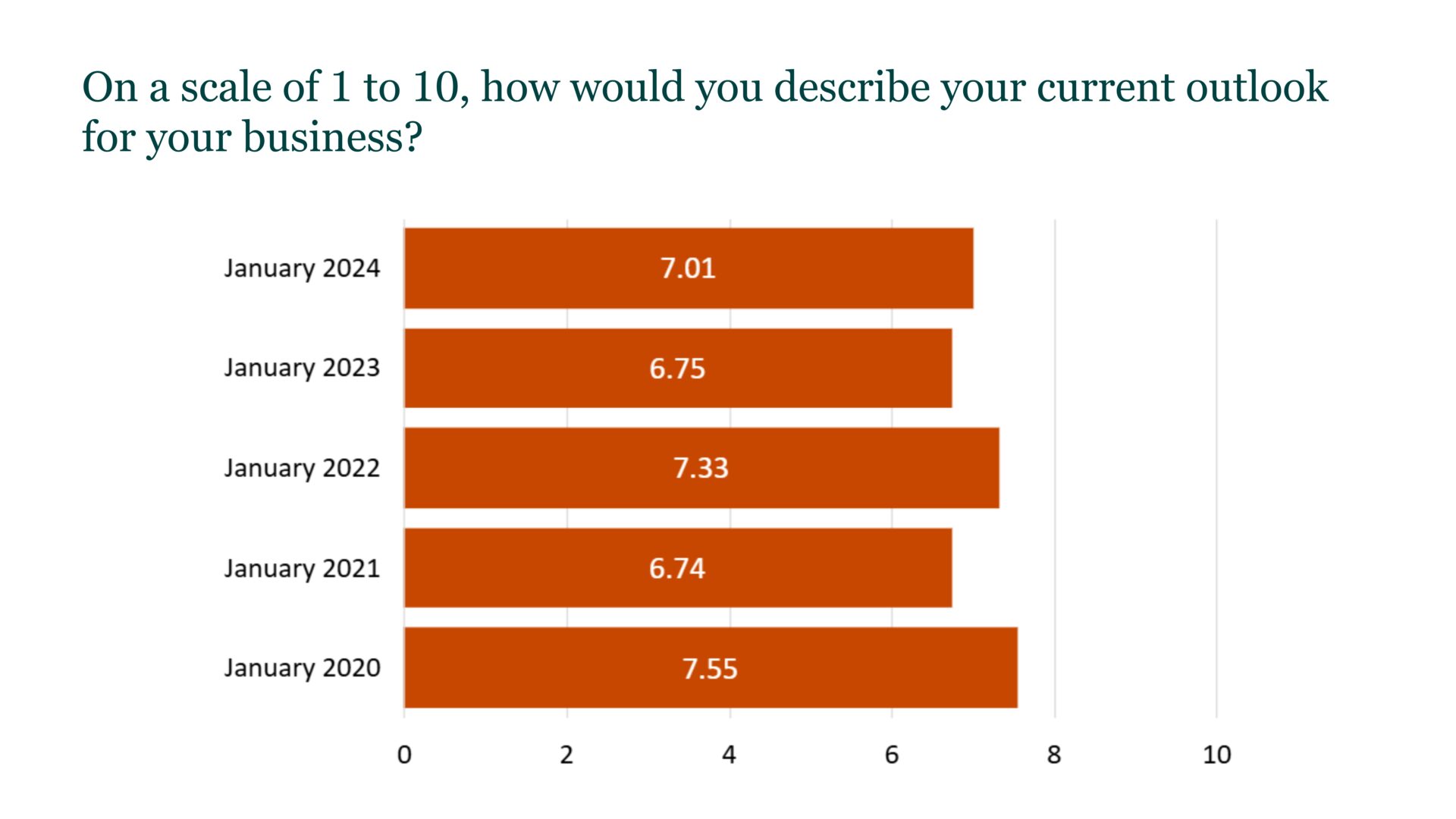

The survey includes a metric we created called the Private Company Sentiment Index. It is intended to present a view of how private company executives feel about their business prospects as well as how that sentiment changes over time. The Index is measured on a scale of 1 to 10. As you can see from the image below, the Index currently stands at 7.01, rebounding somewhat from last year’s number but still lower than the pre-pandemic level of optimism we saw in January 2020.

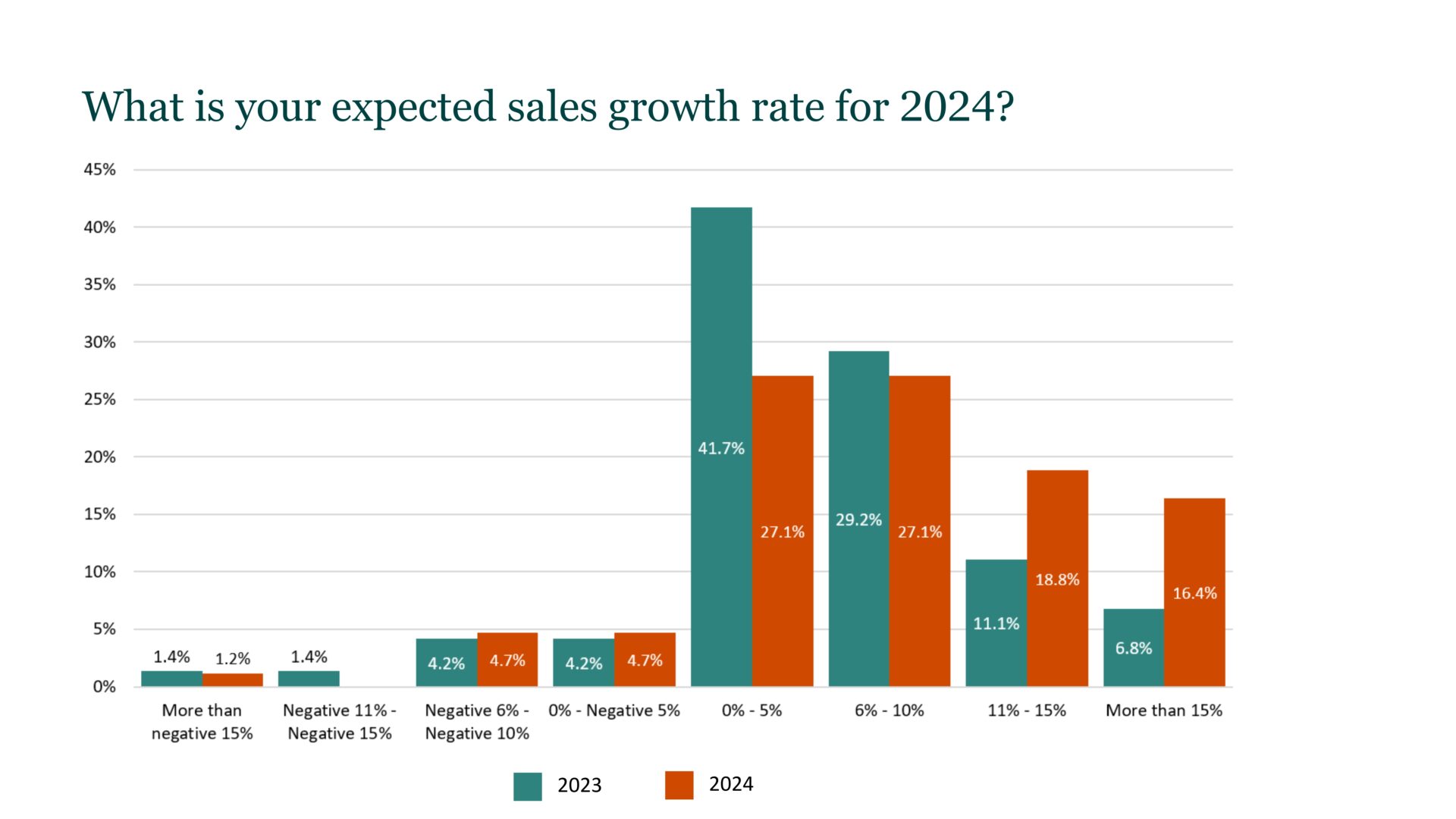

When we asked about expected sales growth rates for 2024, we found that overwhelmingly, private companies expect positive results this year. Plus, they anticipate their growth rates to be stronger in 2024 than 2023.

While the percentage of respondents who anticipated negative growth rates remained relatively the same for 2024 vs. 2023 (roughly 11 percent), we saw a shift in the positive growth categories. In 2023, 42 percent of respondents anticipated growth of up to five percent. That category dropped to 27 percent in 2024.

At the same time, the percentage of respondents who anticipate growth of at least 11 percent increased dramatically, going from roughly 18 percent in 2023 to more than 35 percent in 2024.

We noted several comments from respondents who seemed to feel that 2024 was off to a slow start, but they expect to see a pickup in the second half of the year. One person commented, “We expect a slower rate of revenue for Q1 into Q2, but a stronger finish to the year,” while another said, “[We’ve had] a slow start to the year but the orderbook is filling up again.”

Overall, private companies appear to anticipate impressive business results this year, despite some of the challenges we’ll discuss next.

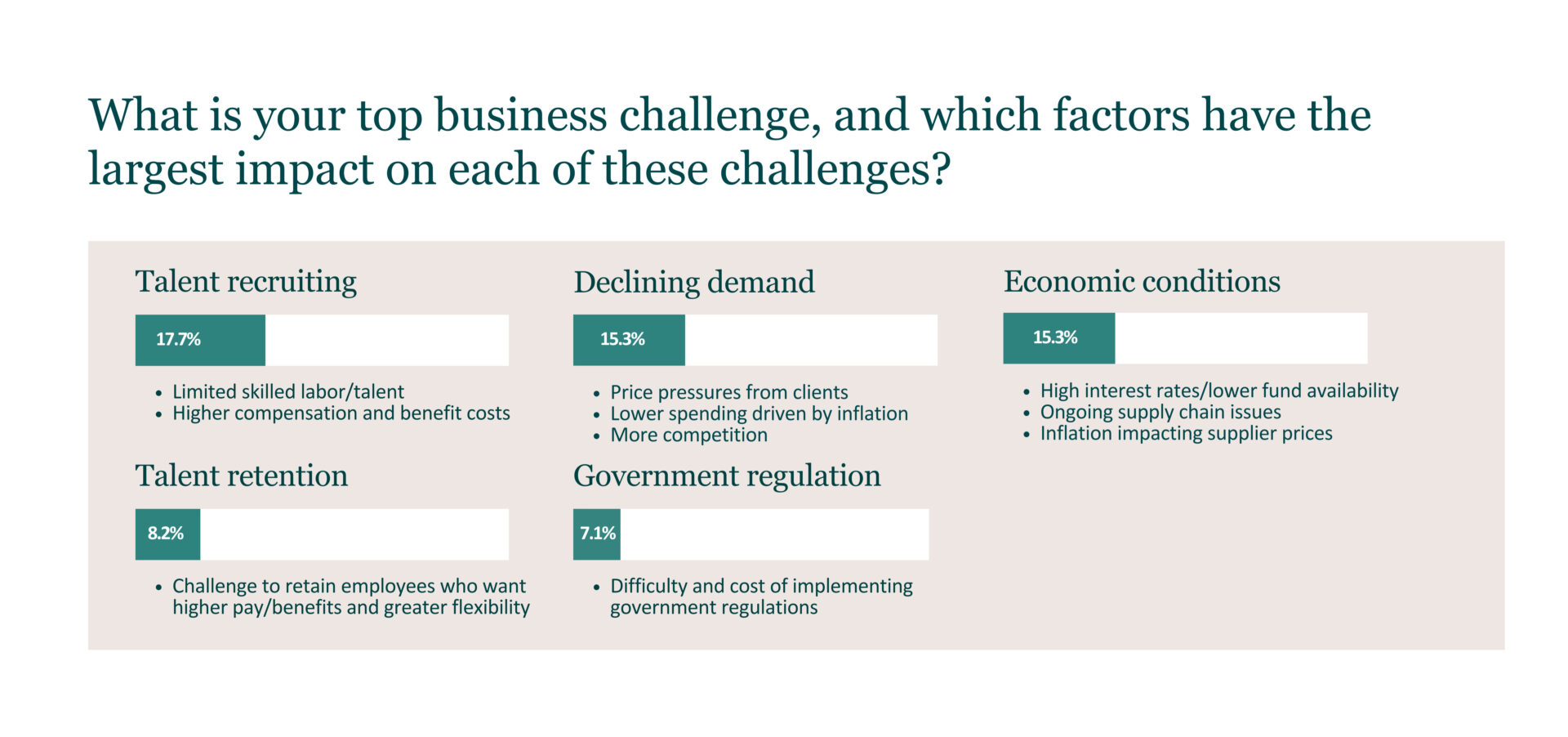

Key Finding #2: Talent recruiting, the economy, and declining demand are expected to be the leading business challenges in 2024.

When we asked survey respondents about their top business challenge, the most-frequently cited answers were talent recruiting, declining demand, and economic conditions. What is driving these challenges?

- Talent recruiting: Respondents noted that there isn’t enough skilled labor/talent available, and they are facing higher compensation and benefit costs in order to successfully attract and retain top talent.

- Economic conditions: The ongoing twin issues of high interest rates and high levels of inflation continue to impact private companies. Inflation is driving up supplier pricing and businesses aren’t always able to pass those costs along to their customers, which impacts profitability. High interest rates make finding available funding a challenge, not to mention more expensive, so some companies are putting the brakes on planned expansion projects or business improvement initiatives. Several respondents also noted that they continue to be plagued by supply chain issues, which seems to be a pandemic-era impact that continues to hang around.

- Declining demand: Inflation is also having an impact on demand. Businesses are seeing their customers tightening their belts and lowering their spending. In many cases they’re also pushing back against price increases, which as we noted previously, is leading to margin compression for businesses. Several respondents also stated that they are seeing more competitors enter their markets, leading to fewer new business opportunities.

It’s interesting to note that declining demand was cited as a top business challenge, yet as we observed earlier, sales growth projects for the year are predominantly positive.

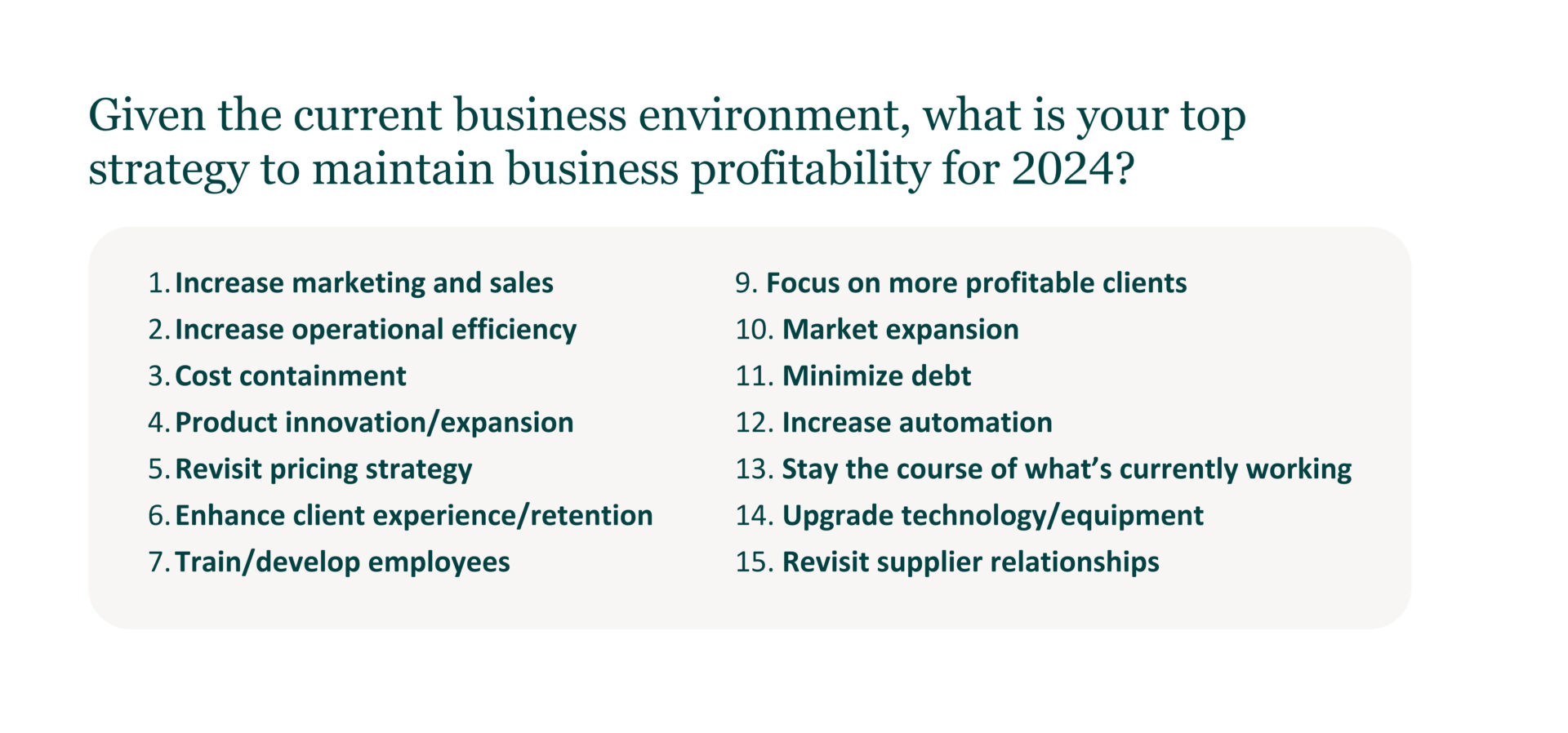

Key Finding #3: To maintain profitability, private companies are revisiting their costs and planning strategic investments.

When we asked about their top strategies to maintain business profitability for 2024 given the current business environment, survey respondents provided a wide array of answers. That said, the top five strategies cited were:

- Increasing investments in marketing and sales

- Driving operational efficiency

- Containing costs

- Investing in product innovation and expansion

- Taking a fresh look at pricing strategies

Lean and mean is the name of the game in the current business climate. By identifying ways to run your business more efficiently and trimming unnecessary costs, you can redirect those savings to investments that will drive business growth, such as marketing, sales, and product innovation.

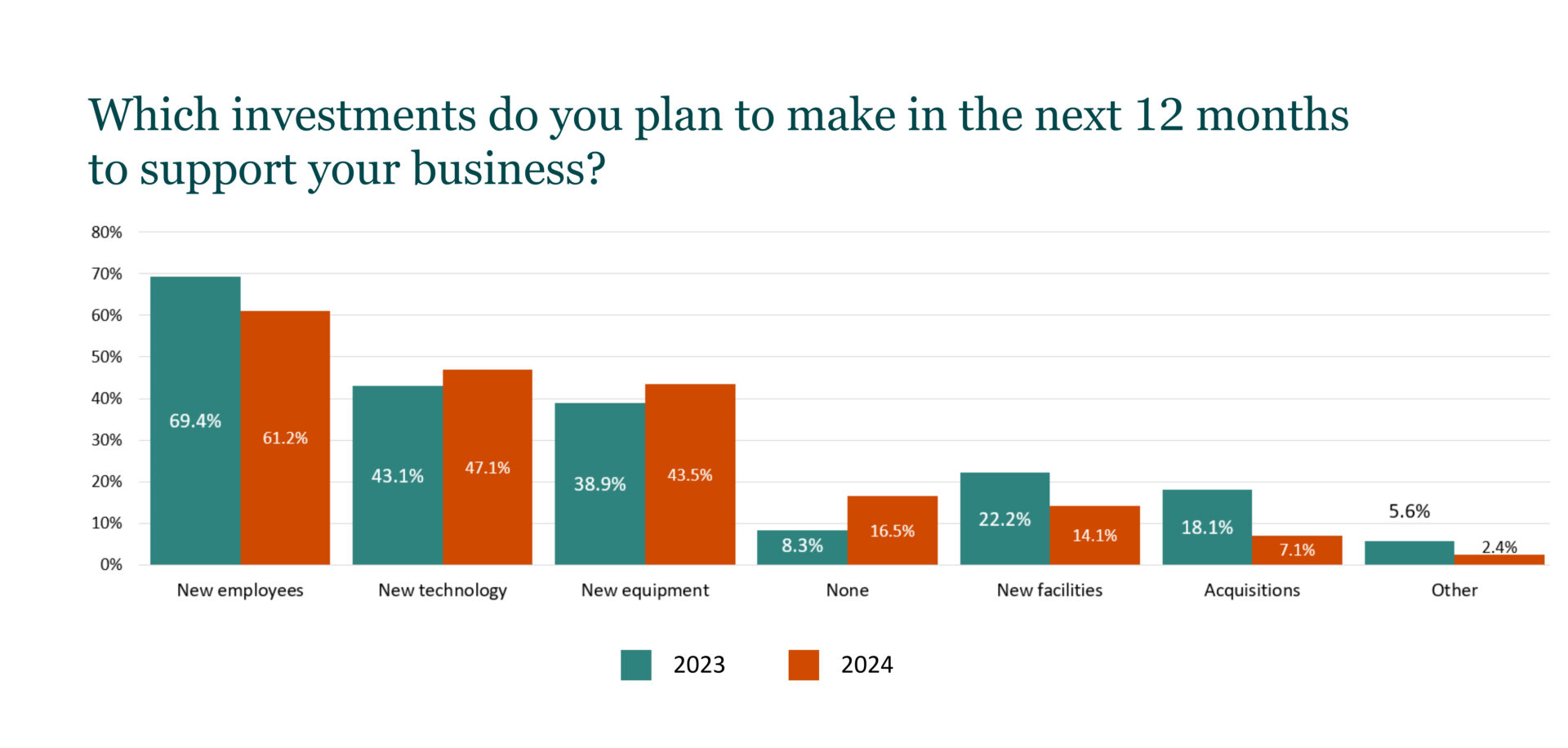

To that end, we also asked about planned investments in the next 12 months. Nearly two-thirds plan to hire new employees and close to half are planning technology improvements. Interestingly, 16.5 percent are not planning any investments in 2024, double the percentage who said that in 2023. Plus, only seven percent are planning to invest in acquisitions this year, which is probably not surprising given the current interest rate environment.

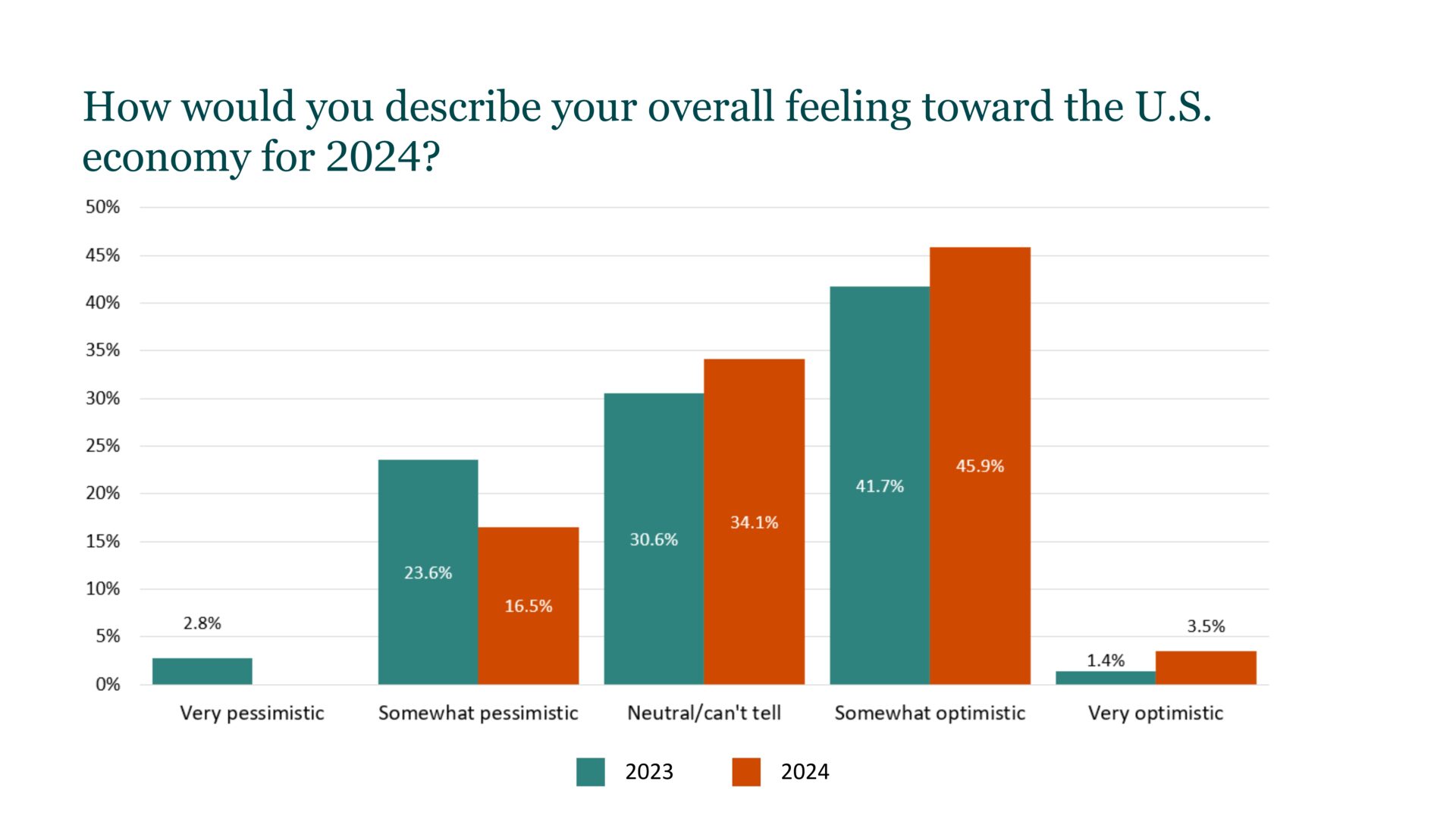

Key Finding #4: Despite being impacted by challenging economic conditions, private companies are surprisingly more optimistic about the economy than they were a year ago.

When asked how they would describe their overall feeling toward the U.S. economy for 2024, close to half of respondents said they were optimistic, versus 43 percent a year ago. Only 16.5 percent said they were pessimistic, versus 26.4 percent last year.

The percentage of respondents who said they were neutral about the economy increased slightly, and that may be due to the fact that it’s an election year. A number of respondents noted in the comments that they’re taking a wait and see approach because there are too many variables in play given the upcoming Presidential election.

When we conduct our next survey in early 2025, we will be on the other side of the Presidential election, and it will be interesting to see how our region’s private companies feel about their prospects in the political, economic, and business climate at that time. Stay tuned!

Methodology

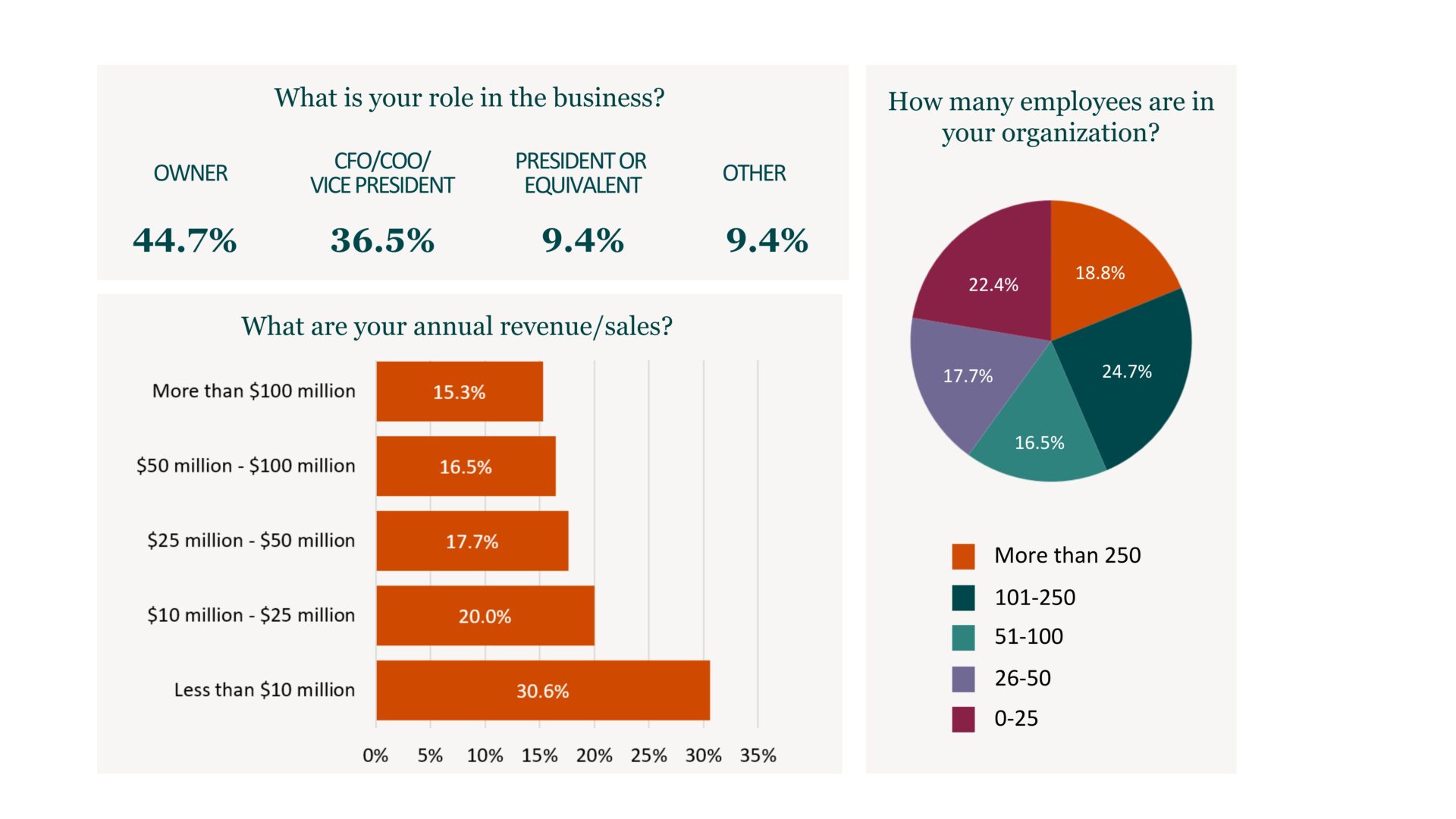

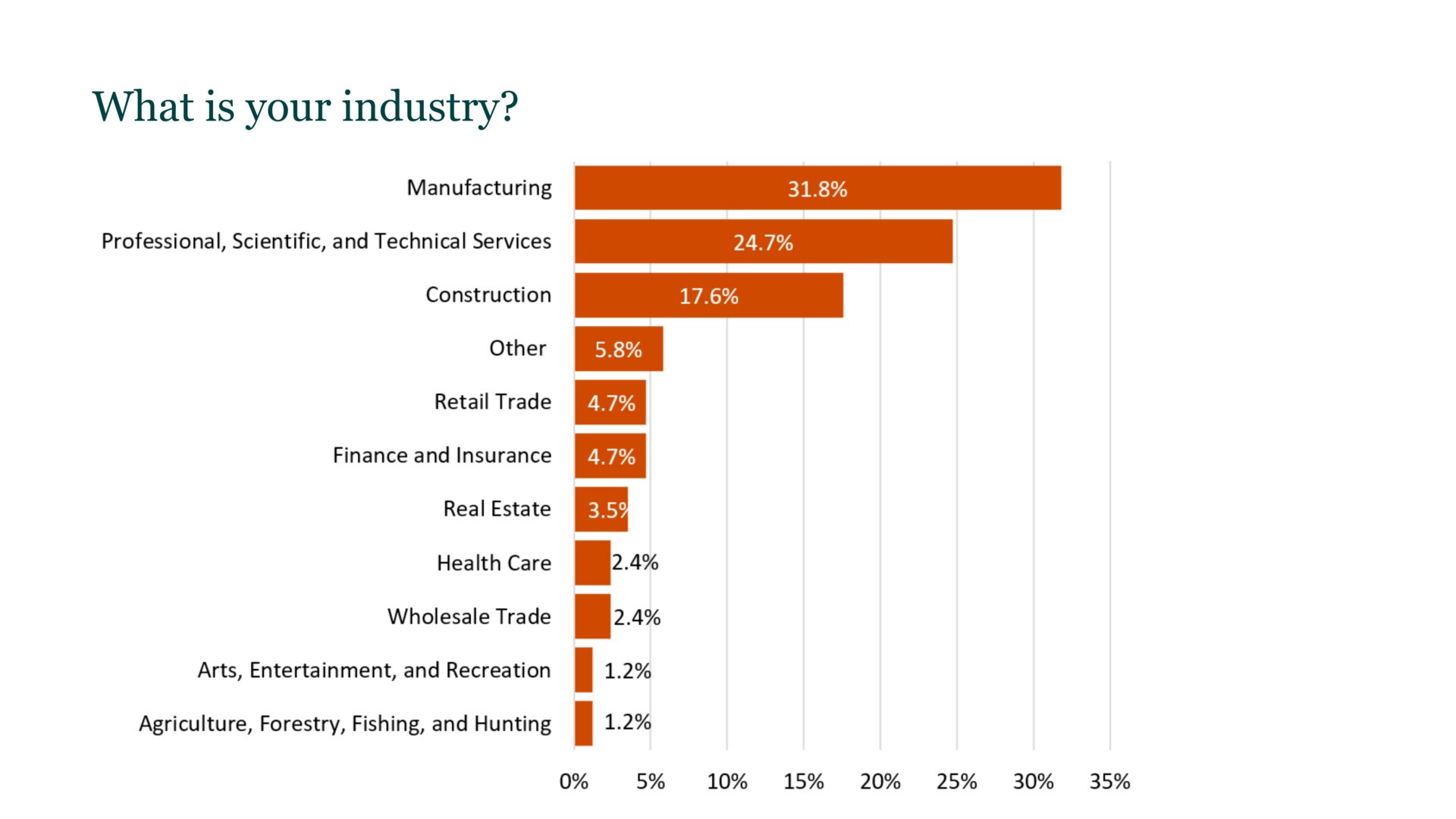

Kreischer Miller’s Private Company Pulse survey was conducted online in March 2024. The survey was sent to privately held and family-owned businesses in the Greater Philadelphia region, including southeastern Pennsylvania, southern New Jersey, and northern Delaware. There were 85 total survey respondents.