What a Difference a Few Months Can Make

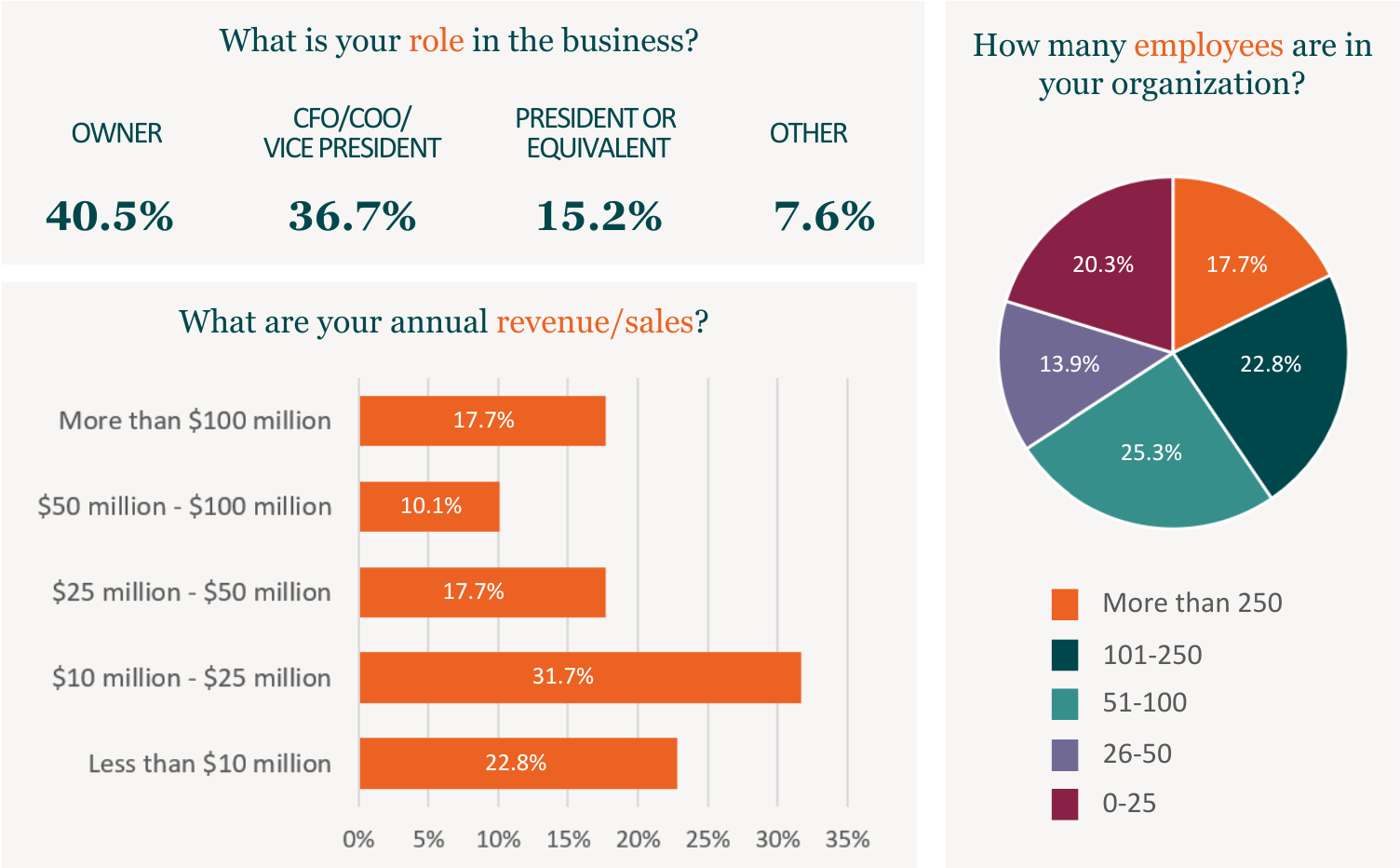

In late January we conducted our annual Center for Private Company Excellence Private Company Pulse survey, which provides insights into the outlook, challenges, and opportunities faced by privately held and family-owned businesses.

When we conducted that survey, many respondents expressed concern about the potential impact of government actions, particularly tariffs, on their businesses and the economy. Given recent events, we decided to conduct a follow-up Quick Poll in mid-April to gauge the current sentiment.

In this article we share the key findings from our original January Private Company Pulse survey, as well as our Quick Poll in mid-April.

Business Outlook

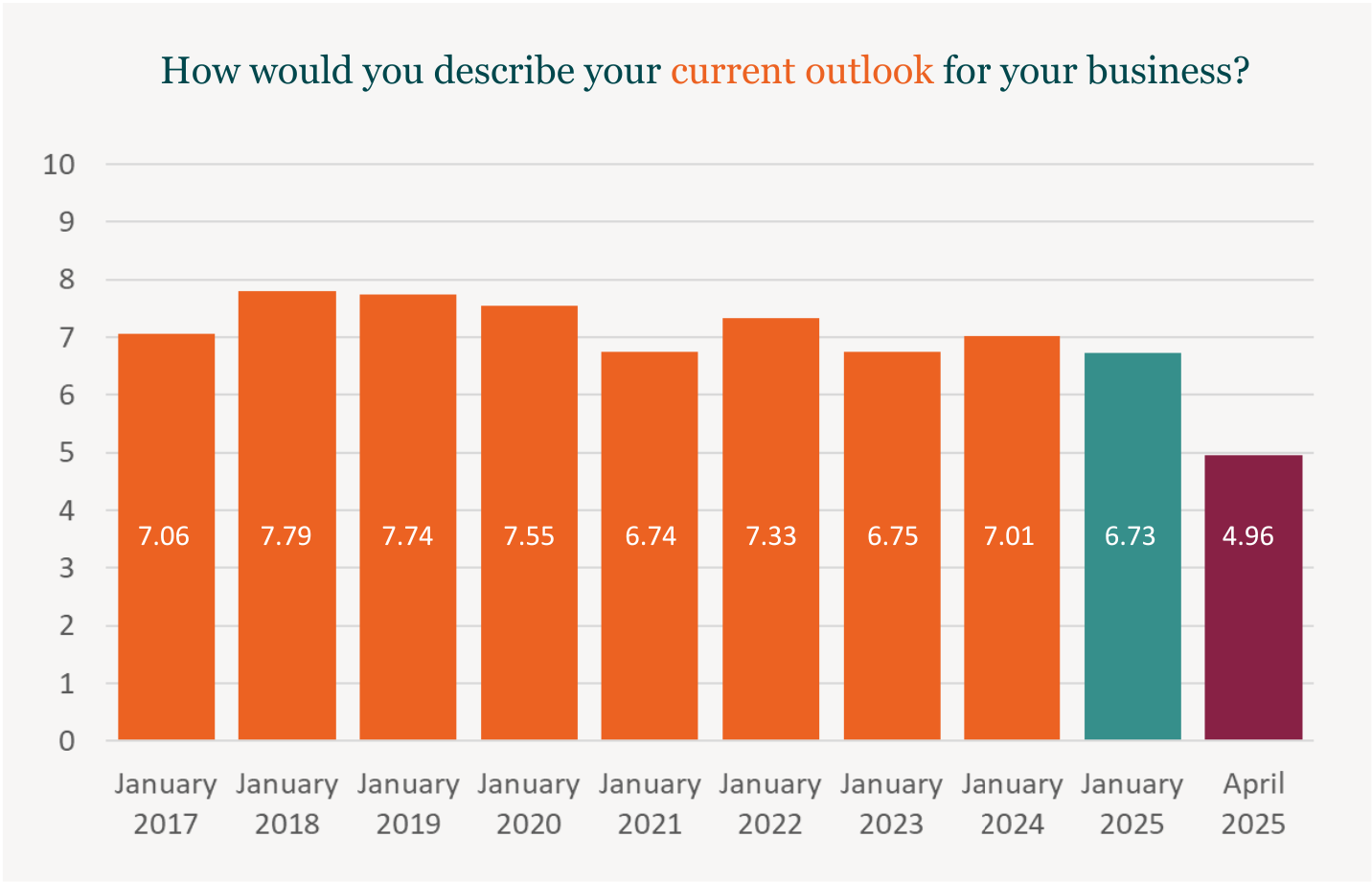

The survey includes a metric we created called the Private Company Sentiment Index. It is intended to present a view of how private company executives feel about their business prospects as well as how that sentiment changes over time. The index is measured on a scale of 1 to 10, with 10 being the most positive.

As you can see from the image below, the index stood at 6.73 in January. While at that time the number indicated an overall business sentiment that was fairly optimistic, the index was at its lowest level since we began conducting our annual survey in 2017. However, in our April Quick Poll, the index dropped even further to 4.96.

In January, several respondents noted an improvement in their sentiment compared to late 2024, and some expressed hope that the new administration would deliver clarity and economic stability. Stronger demand heading into 2025 and anticipated sales growth for the year also contributed to this optimism.

By April, the sentiment had shifted. Many respondents in our follow-up Quick Poll expressed a mixed but increasingly cautious business outlook. While some noted a strong Q1 and continued investment activity, a significant number voiced concern over the impact of tariffs, political instability, and economic uncertainty.

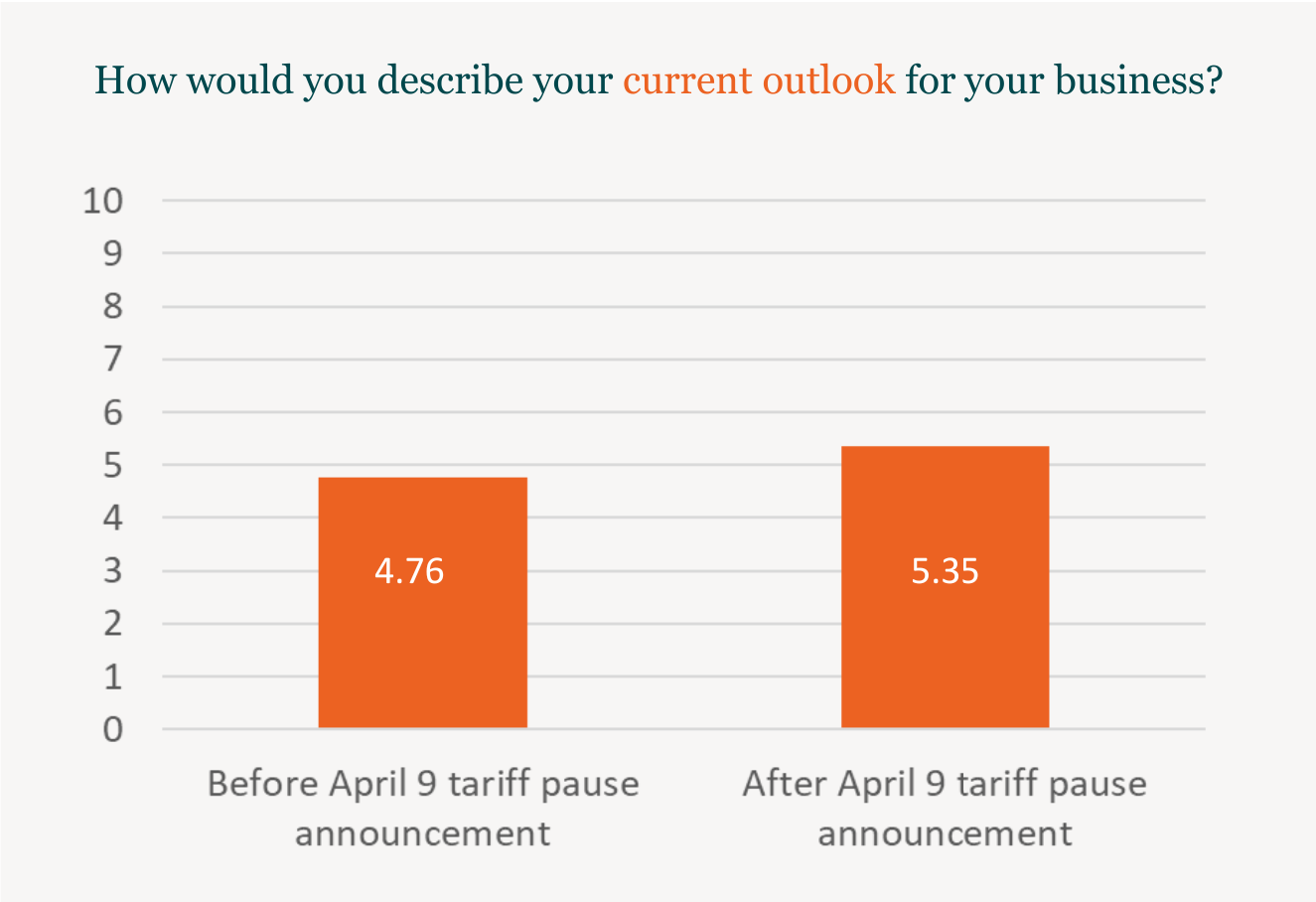

We revisited the timing of the survey responses to assess whether the April 9 announcement of a 90-day tariff pause influenced respondents’ sentiment. As shown in the chart below, the index measured 4.76 prior to the announcement and rose to 5.35 afterward. Although the pause announcement appears to have generated a modest increase in optimism amongst respondents, the post-announcement index remains noticeably below the January level.

One commenter perhaps summed up the general sentiment by saying, “There will be opportunities and threats in this current landscape. My biggest concern is a possible macro slowdown that could overshadow any competitive edge.”

Anticipated Tariff Impacts

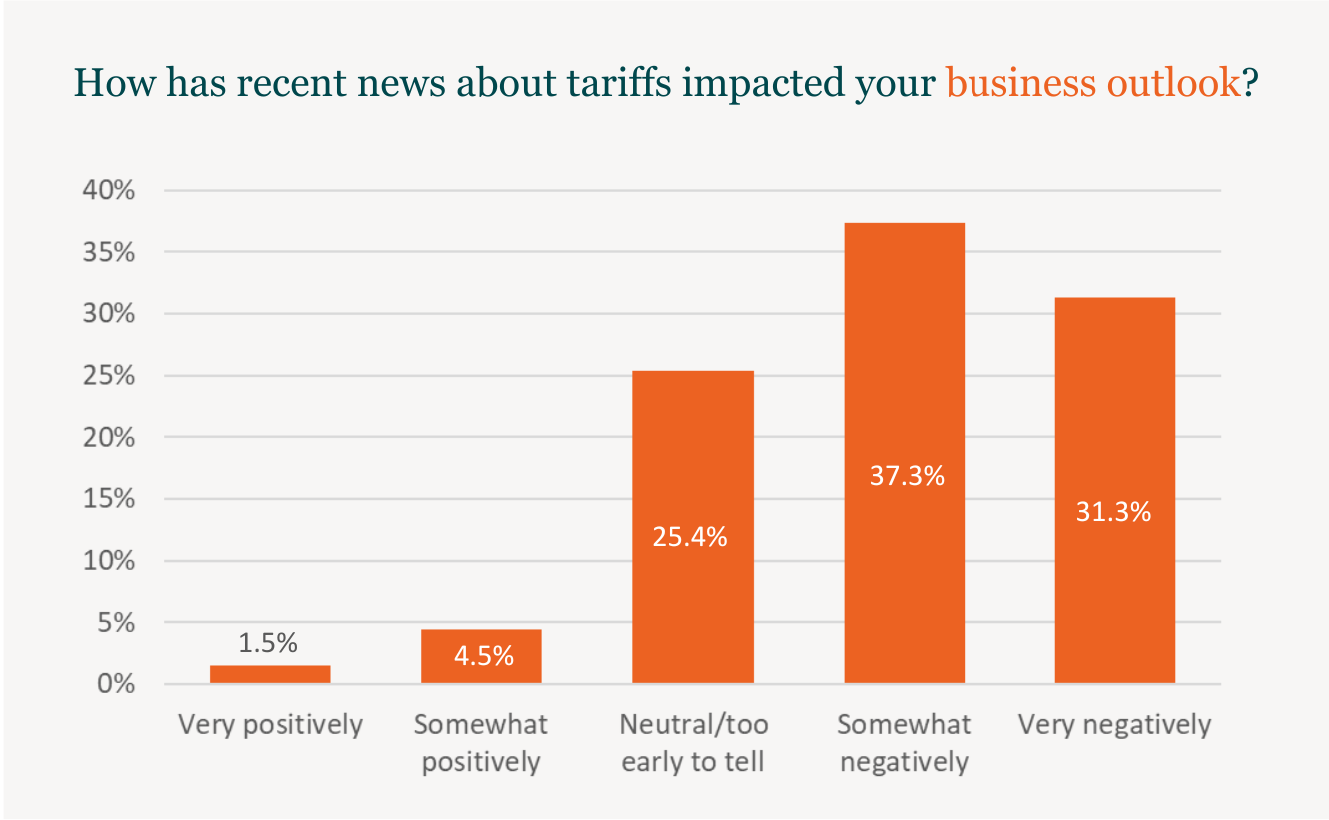

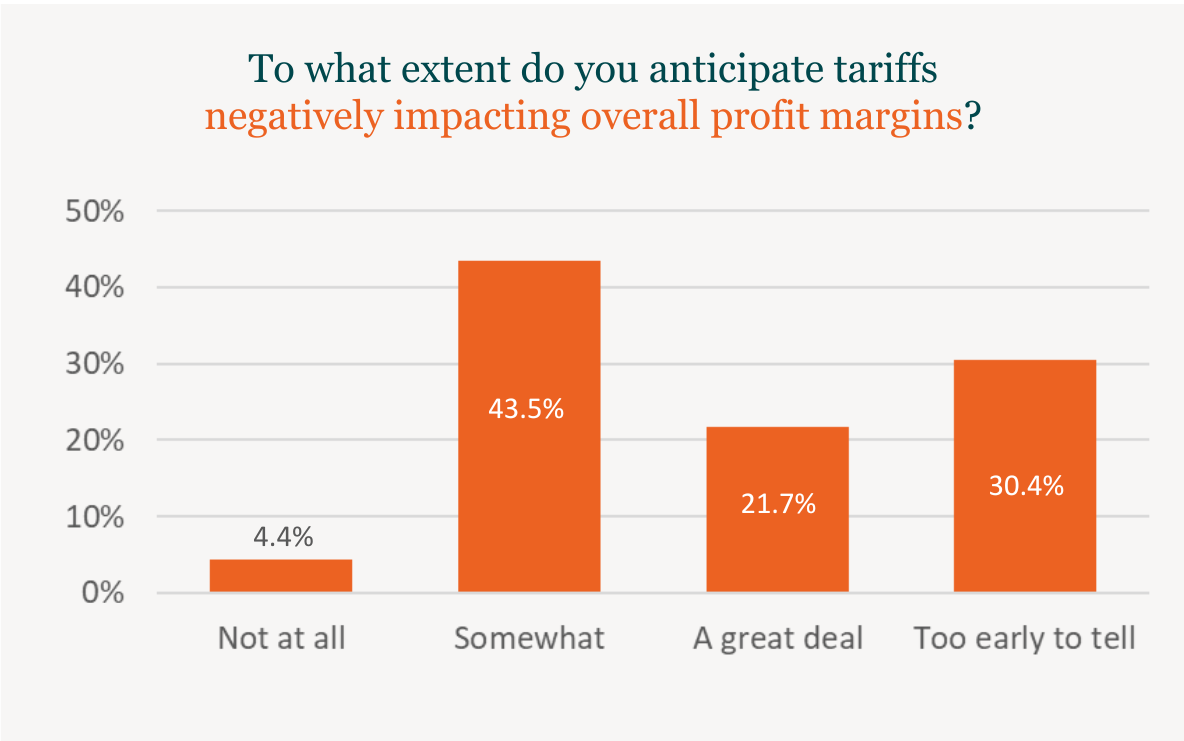

Certainly, the elephant in the room – and the main driver for our April follow-up survey – was the recent tariff announcements. We asked our April respondents how the tariff news has impacted their business outlook. While one-quarter (25.4%) felt it was too early to tell, 68.6% said the tariffs would have a negative impact on their business.

Throughout the survey’s open-ended comments, tariffs were repeatedly cited as damaging to business operations, forecasting, and profitability. Several respondents mentioned a slowdown in leads and bookings, while others highlighted paused projects and client hesitation. Although a few saw potential opportunities in the current environment, the dominant sentiment reflected anxiety over the broader economic and political landscape.

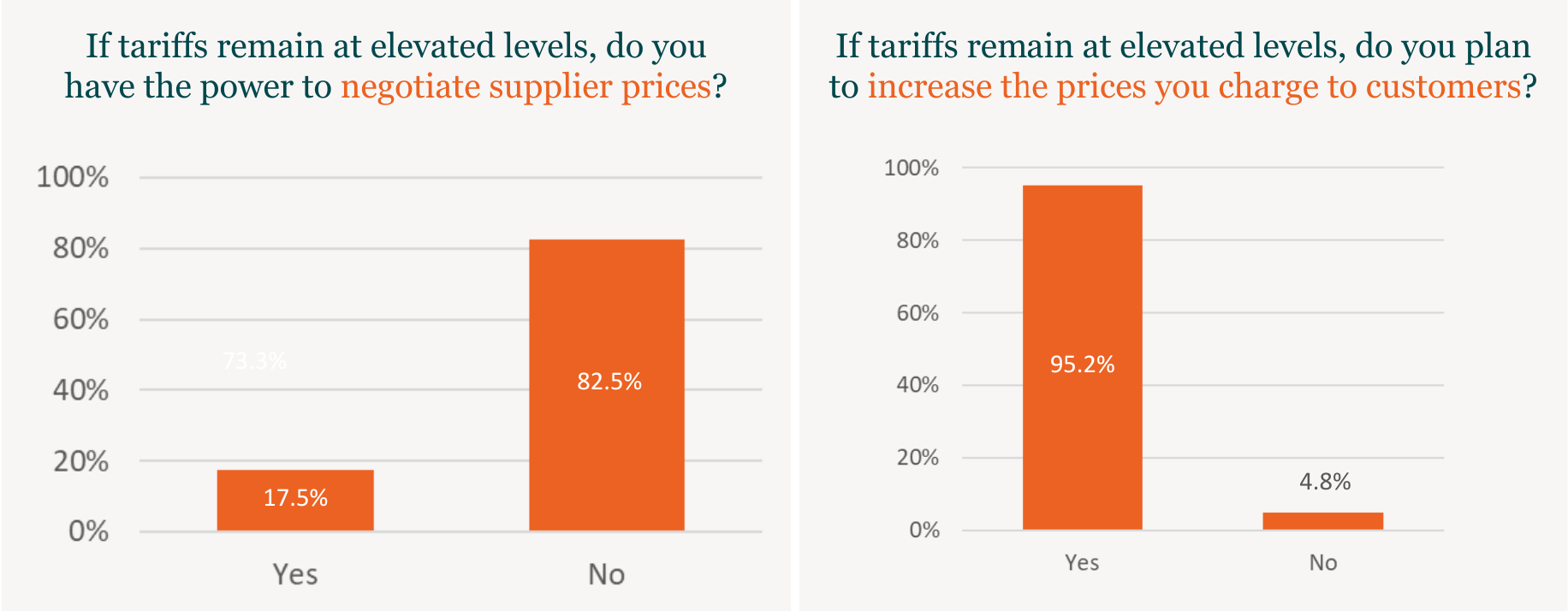

Many respondents also expressed frustration with the unpredictability and perceived mismanagement of tariff policies, noting that the resulting uncertainty is delaying capital expenditures, halting orders, and disrupting supply chains. Common concerns included rising raw material costs—particularly for goods sourced from China—job cancellations, and international trade disruptions. Some noted that the mere anticipation of tariffs has caused suppliers to raise prices.

While one respondent suggested tariffs could have positive effects if implemented thoughtfully, the dominant sentiment was concern over volatility, inflationary pressure, and reduced business confidence.

Strategies to Mitigate Recent Government and Economic Developments

We asked our April survey respondents what actions they’re planning to take – if any – in response to recent developments. Their responses can be grouped into the following key categories:

1. Cost Control and Cash Preservation

A significant number of respondents reported tightening spending to maintain flexibility. Actions include cutting expenses, reducing inventory, freezing hiring, pausing capital investments, and implementing or preparing for layoffs. Many are preserving cash and avoiding large expenditures to stay nimble amid the uncertainty.

2. Pricing Strategy Adjustments

Several noted they are increasing prices to offset expected tariff-related cost increases, while others are monitoring input costs and passing them along to customers where needed. Some are also reevaluating product mix and contract clauses (e.g., escalation clauses) to better navigate the pricing environment.

3. Monitoring and Caution

Many businesses are in a “wait and see” mode—closely monitoring market signals, tariff developments, customer behavior, and supply chain disruptions. These companies are staying cautious but ready to act as more information becomes available.

4. Communication and Client Strategy

Firms are increasing communication with clients and suppliers, informing them of potential cost implications and changes. A few are proactively reaching out to representatives or encouraging pre-purchasing to hedge against future disruptions.

5. Operational Shifts and Strategic Planning

Some respondents are pursuing longer-term strategic adjustments, including reshoring, reengineering, and increasing automation to reduce dependence on volatile external factors. A few mentioned shifting investment strategies or pursuing market expansion opportunities.

6. No Immediate Action

Several businesses indicated that they are not taking any immediate action but remain alert. Some noted that their clients haven’t shown signs of concern yet, while others are maintaining their course until there is more clarity.

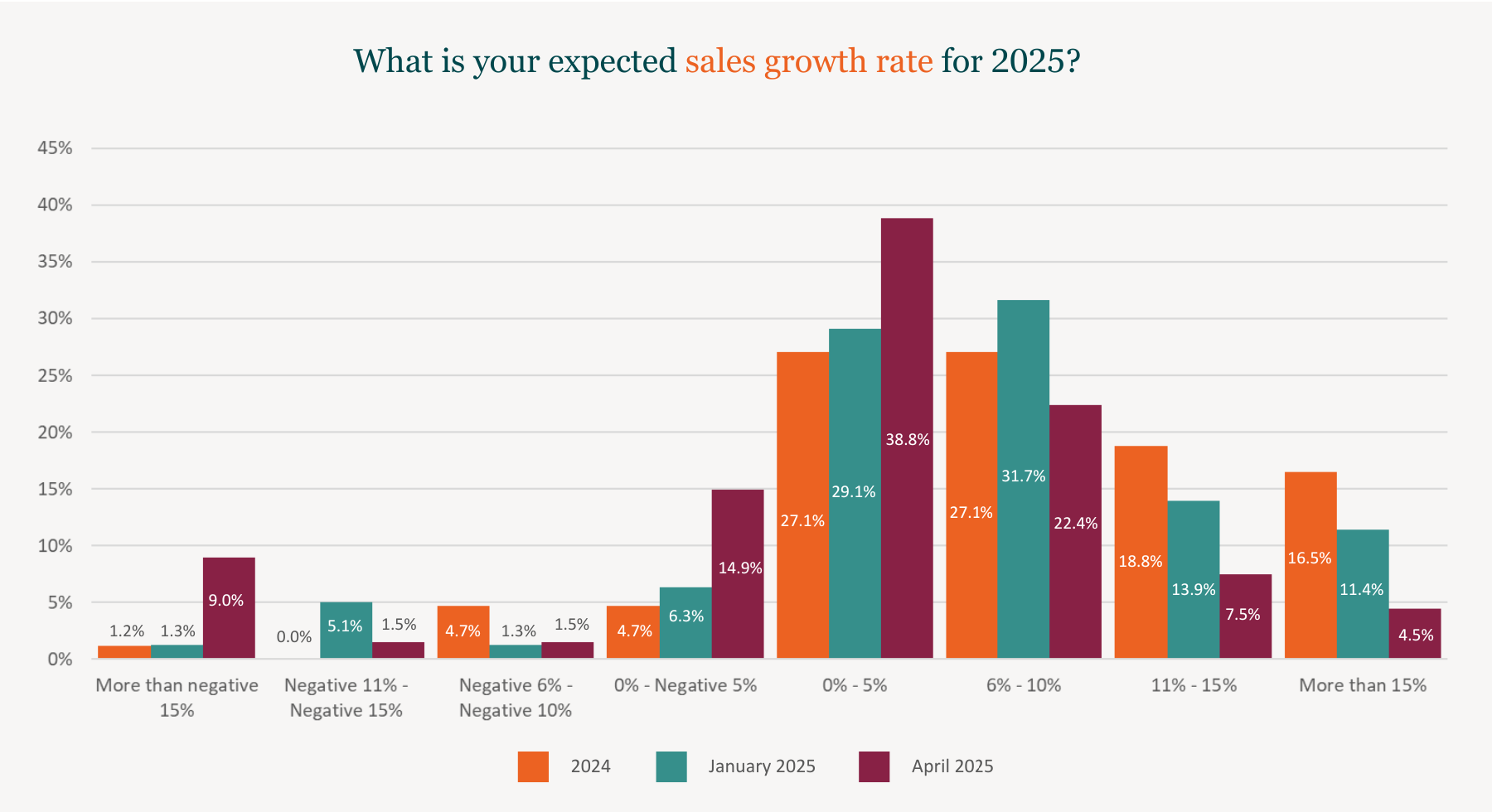

Expected Sales Growth

In our January survey, respondents seemed generally optimistic about their growth prospects. Overall, respondents anticipated moderate growth in 2025, with 31.7% expecting a 6-10% increase. A smaller percentage (25.3%) expected higher growth rates exceeding 10%.

As you can see from the chart below, the sentiment shifted by our early April survey. We now saw more than a quarter of respondents (26.9%) anticipating flat to negative sales growth in 2025.

While 73.1% still expect positive sales growth this year, their predictions for the level of that growth have dimmed as we saw a downward trend from rosier outlooks to more moderate expectations. Nearly 12% of respondents (11.4%) expected growth rates of more than 15% in January, a percentage that dropped to 4.5% in April. And while just under one-third of respondents (29.1%) in our January survey forecast a growth rate of zero to 5%, that percentage jumped to 38.8% by April.

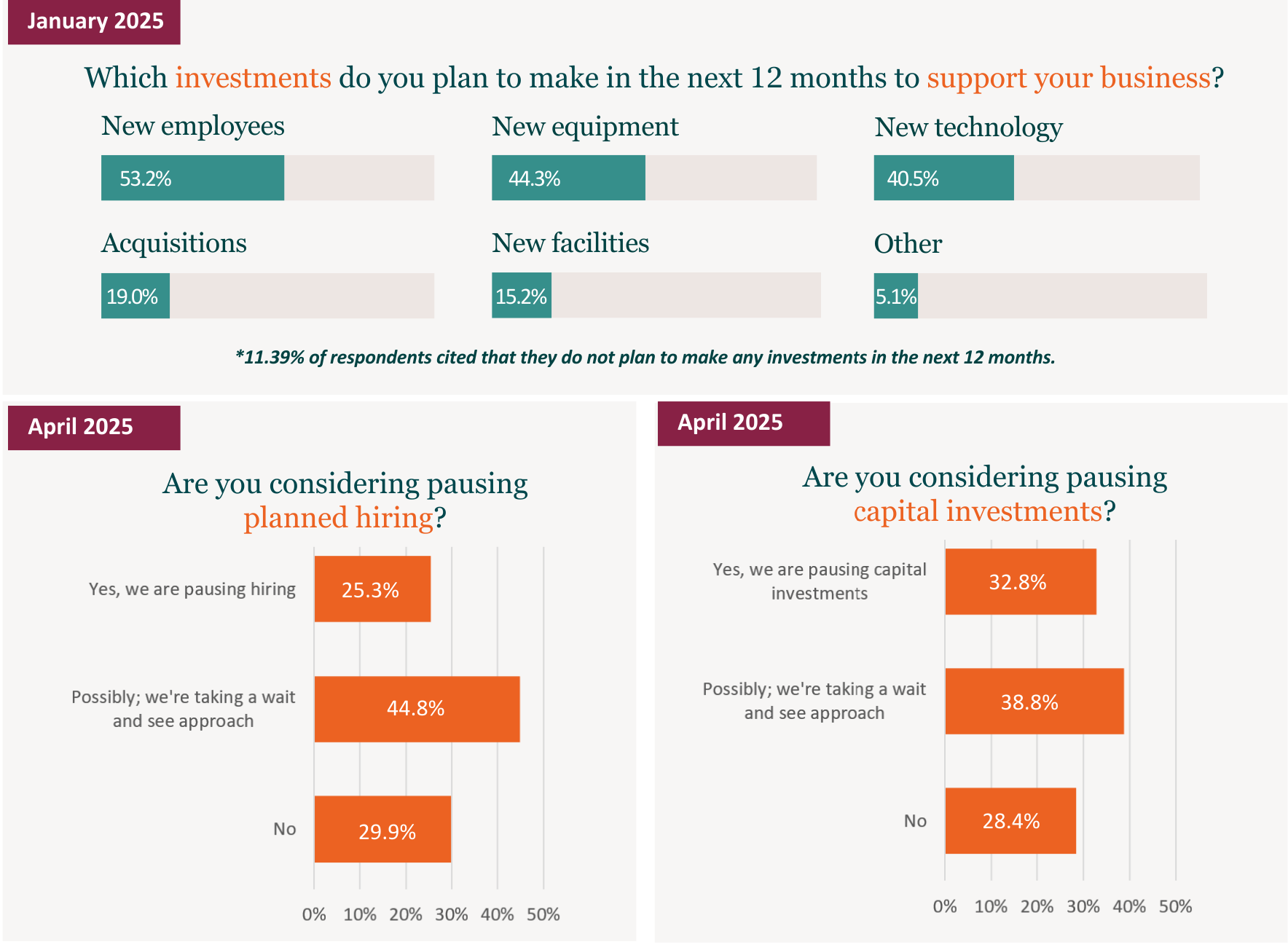

Investment Priorities

When asked in January which investments they planned to make to support their businesses in 2025, more than half of survey respondents (53.2%) cited new employees. Interestingly, the percentage of respondents who said at that time they were planning to make a strategic acquisition nearly tripled. While just 7.1% of last year’s respondents cited this as a priority, this year that percentage jumped to 19.0%.

It seems at least some of those plans may have changed. In our April follow-up survey, we asked whether respondents are considering pausing planned hiring and/or capital investments. Just over one-quarter of respondents (25.3%) are instituting a hiring freeze, with another 44.8% taking a wait and see approach.

Similarly, one-third of April’s respondents (32.8%) are pausing capital investments, with another 38.8% taking a wait and see approach.

As one respondent commented, “We’re hunkering down until all economic indicators change to the positive.”

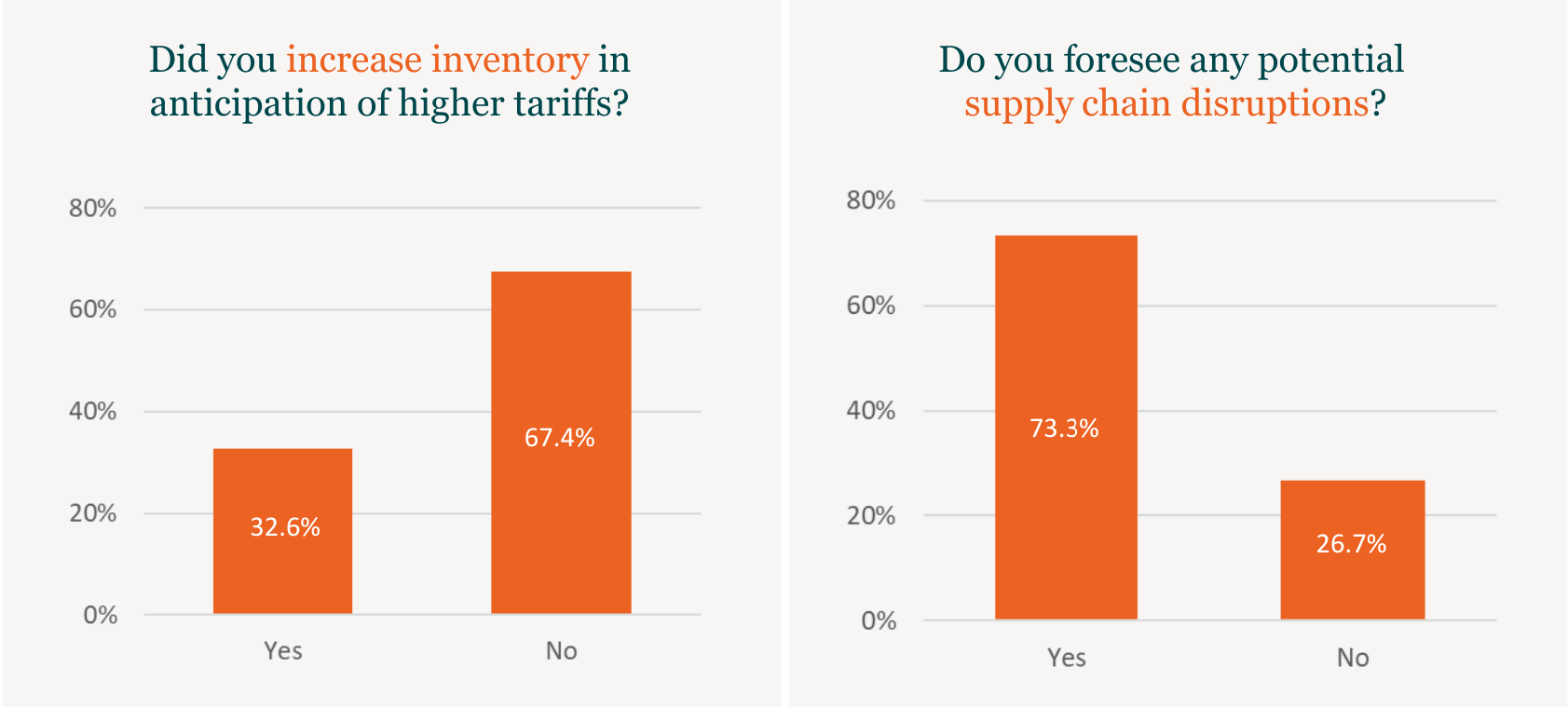

Impact of Tariffs on Manufacturing, Distribution, and Construction

Some industries such as manufacturing, distribution, and construction are naturally more impacted by tariff activity. In our April survey we posed a specific set of questions to respondents in these three industries to gauge their sentiment on recent developments.

Conclusion

When we conducted our initial survey in January, respondents indicated that they would continue to navigate economic uncertainty while focusing on growth and innovation. Talent acquisition, economic conditions, and market expansion were top concerns, while strategic investments in workforce and technology signaled a commitment to future growth. Despite a slight dip in optimism, respondents remained resilient and forward-looking in their planning for 2025.

Fast forward to April. In our follow-up Quick Poll, respondents expressed a high level of concern about the current economic environment, with many citing inflation, recession fears, and political instability as key drivers of uncertainty.

Several respondents criticized recent government actions—particularly around tariffs and trade policy—describing them as unpredictable and damaging to business confidence. Others noted that frequent policy shifts make it difficult to plan or implement strategy, as conditions change too rapidly to react effectively. While some are adopting a wait-and-see stance, many have already observed clients delaying investment decisions or supply chains being disrupted.

Despite the near-term uncertainty, a few respondents maintained a cautiously optimistic long-term outlook, hoping that current challenges might ultimately lead to stronger domestic industries or more favorable trade terms. However, most comments reflected frustration with the perceived lack of clear leadership and concern that economic and geopolitical missteps may have lasting consequences. Overall, the sentiment leans strongly toward caution, with businesses minimizing risk, conserving resources, and preparing for a prolonged period of volatility.

Where do we go from here? Right now, it seems to be anyone’s guess. It will be interesting to look back at 2025 when we conduct our next survey in January to see how the events of this year panned out for privately held businesses in the Greater Philadelphia region.

Methodology

Kreischer Miller’s Private Company Pulse survey was conducted online in late January 2025. The follow-up Quick Poll was conducted online in mid-April 2025. The surveys were sent to privately held and family-owned businesses in the Greater Philadelphia region, including southeastern Pennsylvania, southern New Jersey, and northern Delaware. There were 79 total Private Company Pulse survey respondents in January and 70 total Quick Poll survey respondents in April.