This is part three of a series that provides mobile workforce guidelines for contractors. Part one of this series discussed meals and entertainment and part two addressed accountable plans.

There are many construction companies whose employees do not have a permanent or regular workplace. This leads to the question – do employees receive any kind of reimbursement for travelling to temporary, or even multiple, work locations? And if so, are the reimbursements considered taxable for the employee? This article will break down the different types of workplaces, which reimbursements are considered taxable, and other fringe benefits.

In order to understand which type of reimbursement is allowable for travelling to different workplaces, we will need to define the three terms below.

-

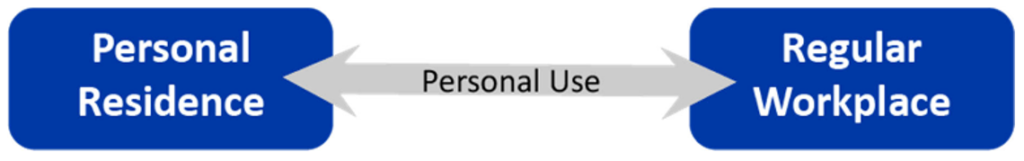

- Regular Workplace – An employee/contractor who works at a specific location on a consistent basis. Regular is defined as someone who performs work at that same workplace for at least a year as described in Revenue Ruling 99-7. Some examples of construction employees who may have a regular workplace include those with administrative and/or finance duties, executives, and project estimators. Travelling to and from your personal residence to your regular workplace is considered commuting and any reimbursement would be considered taxable compensation to that employee (noted as personal use in the chart below).

- Regular Workplace – An employee/contractor who works at a specific location on a consistent basis. Regular is defined as someone who performs work at that same workplace for at least a year as described in Revenue Ruling 99-7. Some examples of construction employees who may have a regular workplace include those with administrative and/or finance duties, executives, and project estimators. Travelling to and from your personal residence to your regular workplace is considered commuting and any reimbursement would be considered taxable compensation to that employee (noted as personal use in the chart below).

-

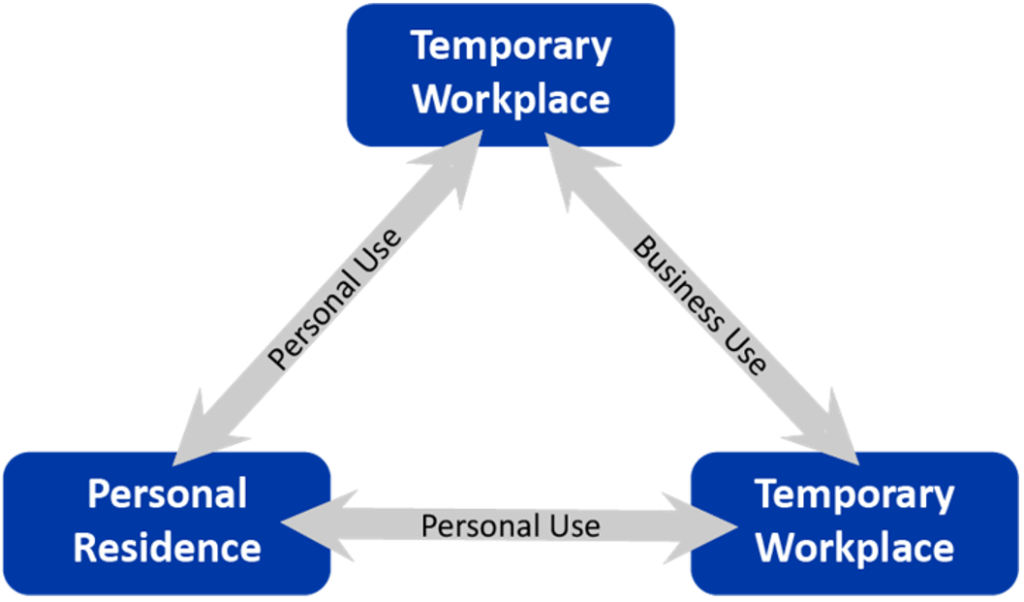

- Temporary Workplace – An employee/contractor who is on an assignment that is expected to be one year or less, or an employee who does have a regular workplace and may need to travel to temporary work locations from time-to-time.An example of a temporary workplace is an employee in finance who has a regular workplace location but travels to jobsites from their personal residence or office to track progress of a certain job. This is considered business mileage and therefore is a nontaxable reimbursement to the employee and deductible for the employer.

- Temporary Workplace – An employee/contractor who is on an assignment that is expected to be one year or less, or an employee who does have a regular workplace and may need to travel to temporary work locations from time-to-time.An example of a temporary workplace is an employee in finance who has a regular workplace location but travels to jobsites from their personal residence or office to track progress of a certain job. This is considered business mileage and therefore is a nontaxable reimbursement to the employee and deductible for the employer.

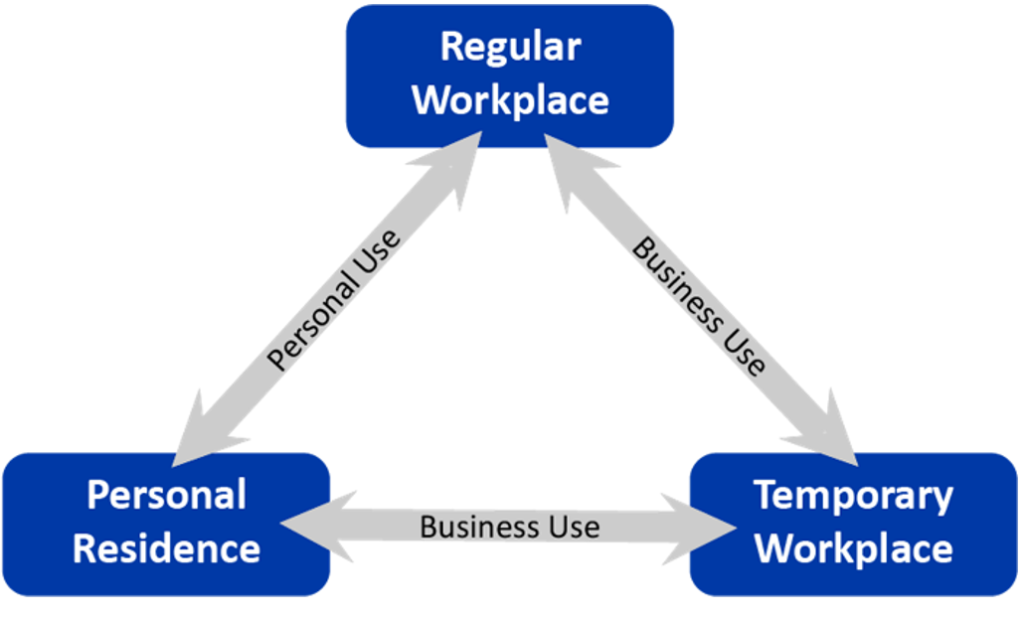

- Multiple Workplaces – Most contracting company employees fall under the multiple workplaces category. This is an employees who is required to visit multiple work locations each day/week or who does not have a regular workplace.Revenue Ruling 55-109 defines travelling between work locations as deductible expenses provided the other rules of an accountable plan are met (see Part 2: Accountable Plans). If the accountable plan allows for travel reimbursement, then the compensation is nontaxable to the employee and deductible to the employer.Please note, travel from home to a temporary work location is considered personal use, but travel to multiple work locations is considered business use. The chart below explains what is considered taxable or non-taxable for multiple workplaces.

Lastly, it’s important to determine whether fringe benefits are considered taxable compensation to the employee. Fringe benefits are other assets outside an employee’s normal compensation that can range from paid time off to the use of a company vehicle. Working condition fringe benefits are typically excluded from an employee’s wages. IRS Publication 15-B explains which benefits are taxable or excluded from an employee’s income. If the benefit is not listed as excludable, then it is required to be included in the employee’s compensation. If an employee picks up the benefit as taxable income, the employer can deduct the expense as wages subject to payroll tax.

This article summarizes why it is essential for a construction company to have a cohesive travel reimbursement policy in place that is accessible to all employees. A well-defined policy will not only prevent unnecessary and non-reimbursable expenses during employee travel, but it will also ensure proper tax treatment for both the employee and employer.

If you have any questions, please contact your Kreischer Miller relationship professional or any member of our Construction Industry Group.

Authors:

Rachel DeFrain, Senior Accountant, Tax Strategies

Tiffany Eichhorn, Senior Accountant, Tax Strategies

***

Information contained in this alert should not be construed as the rendering of specific accounting, tax, or other advice. Material may become outdated and anyone using this should research and update to ensure accuracy. In no event will the publisher be liable for any damages, direct, indirect, or consequential, claimed to result from use of the material contained in this alert. Readers are encouraged to consult with their advisors before making any decisions.

If your business is seeking accounting expertise and advice, please consider Kreischer Miller and contact us to have a conversation.