Dear Clients and Friends,

Happy Summer! Kreischer Miller is pleased to present its Not-for-Profit Update, a quarterly newsletter designed to keep you informed of the latest news in the industry and to provide insights around improving controls, strengthening governance, and enhancing overall operations.

In June 2018, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update No. 2018-08, Clarifying the Scope and the Accounting Guidance for Contributions Received and Contributions Made. The purpose of this ASU is to act as an amendment to ASU 2014-09, Revenue from Contracts with Customers, to reduce the diversity that exists in practice in classifying and accounting for grants and contracts made and received by both not-for-profits and business entities. Organizations need to address these changes now so they can appropriately incorporate the impact of the changes into their FY19/20 budgets and accurately project financial performance. This quarter, our newsletter describes the main provisions of ASU 2018-08, particularly on how it applies to not-for-profit organizations, and provides some key considerations when determining whether a grant/contract should be accounted for as an exchange transaction or as a contribution.

If you would like to discuss any of the content provided here or if you have a topic that you would like us to address in a future newsletter, please do not hesitate to contact me, or any member of Kreischer Miller's Not-For-Profit Industry team. We look forward to hearing from you!

Maxine Romano, CPA, Kreischer Miller

Which Is It: An Exchange Transaction or Contribution?

In May 2014, the FASB issued ASU 2014-09, Revenue from Contracts with Customers (Topic 606) which updated the accounting guidance on revenue recognition for ALL entities, both public and private, including not-for-profit organizations. This standard is intended to provide a more robust framework for addressing revenue issues, improving comparability of revenue recognition practices, and improving disclosure requirements. However, Topic 606 did not clearly address how this standard would apply to grants and certain contributions associated with not-for-profit organizations.

As a result, in June 2018 the FASB issued guidance clarifying the accounting for both the providers and recipients of grants. Accounting Standards Update (ASU) No. 2018-08, Clarifying the Scope and The Accounting Guidance for Contributions Received and Contributions Made (ASU 2018-08) may impact the revenue recognition process for many transactions common to the not-for-profit industry and potentially influence the financial reporting and budgeting process for many not-for-profit organizations. The purpose of ASU 2018-08 is to clarify and improve current guidance about whether the transfer of assets (or reduction or cancellation of liabilities) is a contribution or an exchange transaction.

Both of these new revenue related standards are effective for all entities with annual reporting periods beginning after 12/31/2018, thus effective for calendar years ending 2019 and fiscal years ending 2020.

Any entity (both not-for-profit and business entities) that records revenue from contract agreements is potentially impacted by these standards and needs to assess the impact to its financial reporting process.

Suggested Steps and Considerations

The first step in applying the ASU is to identify all revenue sources and determine which grants and/or similar contracts are exchange transactions vs. contributions. This is an important step since exchange transactions are accounted for under Topic 606 while contributions are accounted for under ASC 958-605 Not-for-Profit Entities – Revenue Recognition (including ASU 2018-08). Topic 606 applies to all exchange transactions, defined as a transaction whereby your organization receives funding and the donor/funding agency receives a direct benefit or "commensurate value in exchange for the assets transferred."

As an example, do your donors/funding agencies receive products or services from your organization in return for their contribution? If they do, then these transactions would be accounted for as an exchange transaction. If the donor/funding agency does not receive a direct benefit, then you need to proceed under the criteria of ASU 2018-08.

An important item to note here is that a benefit received by the public as a result of the assets transferred is NOT equivalent to commensurate value received by the resource provider, as is often the case with grants/contracts from government agencies. Thus, many of your government grants and contracts would need to be assessed under the criteria of ASU 2018-08.

Once it is determined that your revenue source is not an exchanged transaction, the second step is to determine if the contribution/grant is conditional.

Per ASU 2018-08, “a donor imposed condition must have both:

- One or more barriers that must be overcome before the recipient is entitled to the assets transferred or promised.

- A right of return to the contributor for assets transferred (or for a reduction, settlement, or cancellation of liabilities) or a right of release of the promisor from its obligation to transfer assets (or reduce, settle, or cancel liabilities).”

If either is absent, the grant/contribution is unconditional and revenue is recognized immediately.

ASU 2018-08 provides the following indicators to consider when determining whether a barrier exists:

- A measurable performance-related barrier or other measurable barrier. Examples include a requirement that indicates that a recipient’s entitlement to transferred assets is contingent upon the achievement of a certain level of service, an identified number of units of output, or a specific outcome. Another example of a measurable barrier is a stipulation that the recipient is entitled to the assets only upon the occurrence of an identified event (for example, a matching requirement).

- Limited discretion by the recipient on the conduct of an activity. Limited discretion by the recipient is more specific than the general activity being conducted by the recipient or the time frame in which the contribution must be used. Examples of limited discretion could include a requirement to follow specific guidelines about qualifying allowable expenses (i.e., compliance with the cost principle requirements under the Uniform Guidance), a requirement to hire specific individuals as part of the workforce conducting the activity, or a specific protocol that must be adhered to.

- Whether a stipulation is related to the purpose of the agreement. This indicator generally excludes administrative tasks and trivial stipulations, thus just producing an annual report generally will not be considered a barrier.

For a condition to exist it MUST be determinable from the agreement or a document referenced in an agreement that a recipient is only entitled to the transfer of assets if it has overcome the barrier. Some transactions will require more judgement to determine whether an agreement contains a barrier, but ASU 2018-18 indicates that a contribution containing stipulations that are not clearly unconditional shall be presumed to be a conditional contribution.

The second consideration of a conditional contribution is the right of return; that the grant/gift/contract agreement indicates that if the organization does not overcome the barrier, the donor/grantor is released from its obligation to transfer the promised resources or if the funds were received in advance, has the right to demand their return. The agreement need not use those exact words, and the right may be communicated in another document referenced by the agreement (e.g., Uniform Guidance, Federal Cost Circulars, a foundations standard terms and conditions).

If the contribution is determined conditional, revenue would be recognized as the conditions are met. If the funding is determined to be unconditional, the third step would be to proceed to determine if the contribution is with or without donor restrictions and recognize revenue immediately in the appropriate net asset class as was done previously.

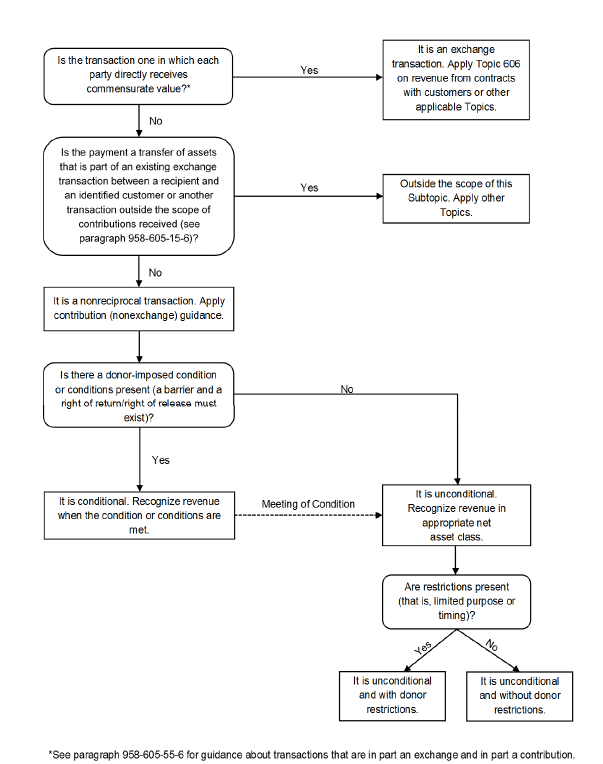

We recognize that there is a lot of information. To begin addressing these new standards, we recommend that management begin to review all contracts/grants to determine if they are exchange transactions vs. contributions under the new guidance. While this process may appear a bit cumbersome, it is necessary in order to allow time to update your financial reporting processes (i.e., general ledger accounts, groupings, and classifications) as deemed necessary and to compile an accurate budget for the upcoming fiscal year. Following is a diagram from ASU-2018-08 illustrating the process for determining whether a transfer of assets to an organization is a contribution, an exchange transaction, or another type of transaction, whether a contribution is conditional vs. unconditional, and whether it is restricted or unrestricted. ASU 2018-08 has many examples to assist management in making the proper determination. Please do not hesitate to request a copy of ASU 2018-08 or reach out to any member of Kreischer Miller’s Not-for-Profit industry group for assistance.

Implementation Guidance from ASU 2018-08:

***

Information contained in this alert should not be construed as the rendering of specific accounting, tax, or other advice. Material may become outdated and anyone using this should research and update to ensure accuracy. In no event will the publisher be liable for any damages, direct, indirect, or consequential, claimed to result from use of the material contained in this alert. Readers are encouraged to consult with their advisors before making any decisions.