Thinking of a business transition? Knowing what's important before evaluating your options is key. Embarking on this new chapter as a private company owner can be both exciting and daunting. The decisions you make now will shape the future not only for you but also for your employees and stakeholders. This guide aims to illuminate the critical aspects of business transition planning, ensuring you are equipped with the knowledge to make informed decisions.

Understanding Your Motives for Transition

Why Are You Considering a Transition?

Before anything else, it’s essential to grasp why you’re contemplating leaving your business. This foundational step is often overlooked, but it can significantly influence the path you choose. Are you seeking financial freedom, more family time, or a new entrepreneurial challenge?

Understanding your motives helps align your transition strategy with your personal goals. Are you driven by the desire to maximize profits, or are there other factors, such as legacy or employee welfare, that matter more?

Beyond Money—What Else Drives the Decision?

While financial gain is a natural consideration, it’s not always the sole motivator. Family commitments, community involvement, and professional legacy can be equally compelling reasons to transition. Reflect on what you value most and how it aligns with your life post-transition.

Consider the impact on your employees and the legacy you wish to leave behind. If maintaining the company culture and supporting your team are crucial, it may lead you to explore options like employee ownership.

The Balance of Emotional and Practical Considerations

Navigating a business transition involves balancing emotional and practical considerations. Emotional readiness is just as important as financial preparedness. Are you ready to step away from daily operations, or do you envision a gradual shift?

Transitioning is not merely a financial transaction—it’s a significant life change. Being emotionally prepared ensures you make decisions that are in harmony with your long-term aspirations.

The Importance of Knowing Your Business Value

How to Obtain an Accurate Business Valuation

Knowing what your business is worth is a critical step in business transition planning. An accurate valuation provides a baseline that guides your negotiations and decision-making. Engage with valuation professionals who can offer an unbiased assessment based on current market data.

An accurate valuation sets realistic expectations during negotiations. It can also highlight areas where your business excels and identify potential improvements to increase its value.

Factors Influencing Business Valuation

Several factors influence a business valuation, including income potential, asset values, and market conditions. A comprehensive evaluation considers these elements to provide a clear picture of your company’s worth.

Understanding these factors helps you position your business favorably in the eyes of potential buyers or successors. Clarity on these metrics allows you to plan strategically for potential negotiations.

Utilizing Valuation in Strategic Planning

A thorough valuation assists in strategic planning, ensuring your transition aligns with your goals. It informs financial projections and tax implications, crucial for preparing a seamless transition.

Use the insights gained from valuation to enhance business strengths and address weaknesses. This proactive approach not only improves your negotiation stance but also enhances your company’s appeal to potential buyers.

Exploring Options to Transfer Out of Your Business

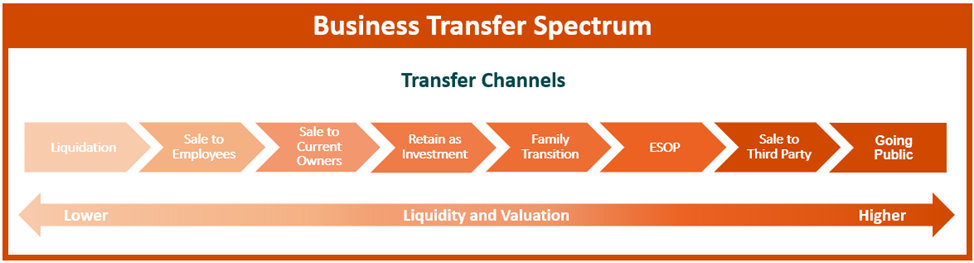

Liquidation and Public Offering

Liquidation and public offering sit at opposite ends of the business transfer spectrum. Liquidation should be a last resort, because it often results in the lowest returns. Conversely, a public offering involves substantial costs and regulatory hurdles, and is typically reserved for larger enterprises.

Being aware of these extremes helps you appreciate the range of options available. It underscores the importance of strategic planning and exploring alternatives that suit your specific circumstances.

Selling to Employees or Current Owners

Selling to employees can preserve your company’s culture and legacy, though it may not fetch the highest price. Similarly, selling to current owners offers flexibility but often involves conservative valuations.

Consider the long-term impact on your business and its people. These options are ideal if maintaining continuity and culture is more important than maximizing financial return.

Family Transition and ESOPs

A family transition offers flexibility and aligns with long-term legacy goals. Employee Stock Ownership Plans (ESOPs) provide both cultural and cash flow benefits, though they require careful navigation of regulatory requirements.

These options offer the potential for a smooth transfer that aligns with personal values and business objectives. They facilitate gradual transitions, ensuring stability and continuity.

Selling to a Third Party

Selling to a third party often yields higher valuations due to external capital involvement. However, it involves less flexibility in terms of timing and structure.

Evaluate this option if maximizing financial return is your primary goal. Proper planning can mitigate potential challenges associated with reduced flexibility.

Key Considerations and Next Steps

Being Proactive in Transition Planning

Proactive planning is crucial to a successful business transition. Begin with self-reflection to understand your motives, followed by a comprehensive business valuation to guide your strategy.

Taking the initiative ensures you have control over the process, rather than reacting to external pressures. It provides clarity and confidence as you move forward.

Aligning Goals with Transition Strategy

Align your personal and professional goals with your transition strategy. This alignment ensures decisions made today support your long-term vision.

This strategic alignment helps avoid common pitfalls and ensures the transition is harmonious and rewarding for all parties involved.

Avoiding the Last Resort—Liquidation

Avoid liquidation by exploring all viable options—and planning well in advance. Liquidation often results in the lowest returns and should be a contingency rather than a primary strategy.

Understanding the full spectrum of options allows you to make informed choices that prioritize your business’s continued success and your personal fulfillment.

Steps Your Organization Can Take to Start Planning for a Business Transition

Contemplating a business transition involves more than technicalities like M&A climate and taxes. It requires introspection, strategic planning, and an understanding of your business’s true value. By considering your motives, evaluating your company’s worth, and exploring various transition options, you equip yourself with the tools needed to make confident, informed decisions. This proactive approach not only ensures a smoother transition but also maximizes your business’s potential and secures your legacy.

For those looking to explore further, please feel free to contact our business transition planning experts for valuable insights and guidance tailored to your unique situation.