The M&A market has seen volatility in its volume and valuations throughout 2022 and 2023. This unpredictability can be attributed to macroeconomic uncertainty, volatile capital markets, and the rising cost of capital. Despite the lingering uncertainty, the M&A landscape saw private company earnings before interest, taxes, depreciation, and amortization (EBITDA) multiples return to relatively normal historical levels by the second quarter of 2023.

Gaining an understanding of recent trends in multiples within your specific industry can aid in evaluating your business’ worth to plan for a potential transaction. This article will provide a summary of information from the DealStats Value Index for Q2 2023, with a focus on private companies.

Multiples exhibited significant variations throughout 2022. The median selling price per EBITDA across all industries increased from 2.9x at Q1 2022 and Q2 2022, to 3.8x at Q3 2022, and then decreased to 3.5x at Q4 2022.

EBITDA multiples continued to fluctuate in 2023, declining to 3.2x in Q1 2023 and rebounding to 4.0x in Q2 2023. Despite these fluctuations, EBITDA multiples through Q2 2023 appeared more in line with historical levels experienced from 2017 to 2021, ranging from 3.5x to 5.0x EBITDA.

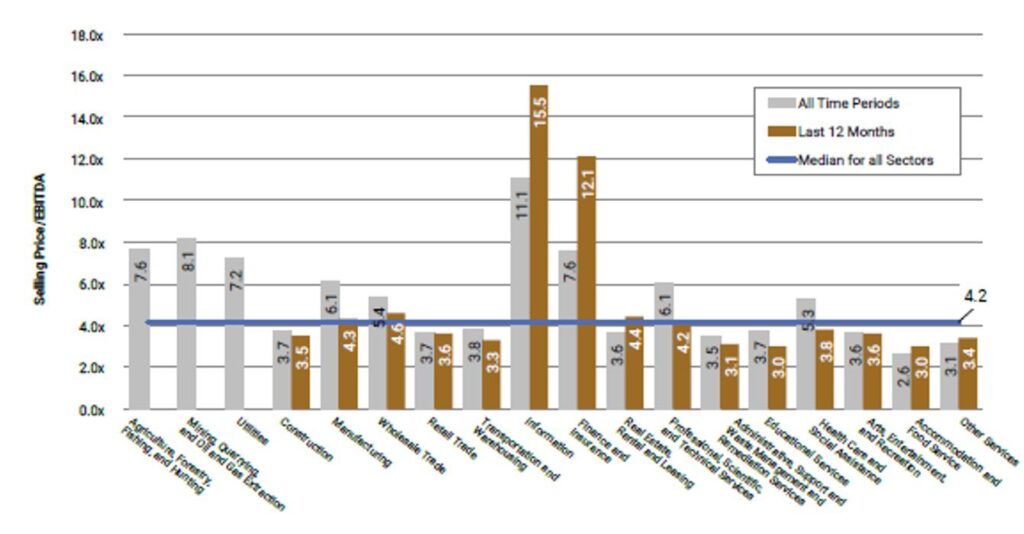

EBITDA multiples varied significantly by industry. Over the past twelve months, the information sector yielded the highest selling price for EBITDA at 15.5x, followed by finance and insurance at 12.1x. The food service industry and educational services yielded the lowest selling price for EBITDA at 3.0x.

The table below illustrates the median selling price per EBITDA by industry for private companies:

Consistent with our Q1 2022 M&A Market Update, companies in the mining, quarrying, and oil and gas extraction sector; the finance and insurance sector; utilities sector; agriculture, forestry, fishing, and hunting sector; and the information sector continued to transact at higher net sales and earnings-based pricing multiples than most companies in other industries.

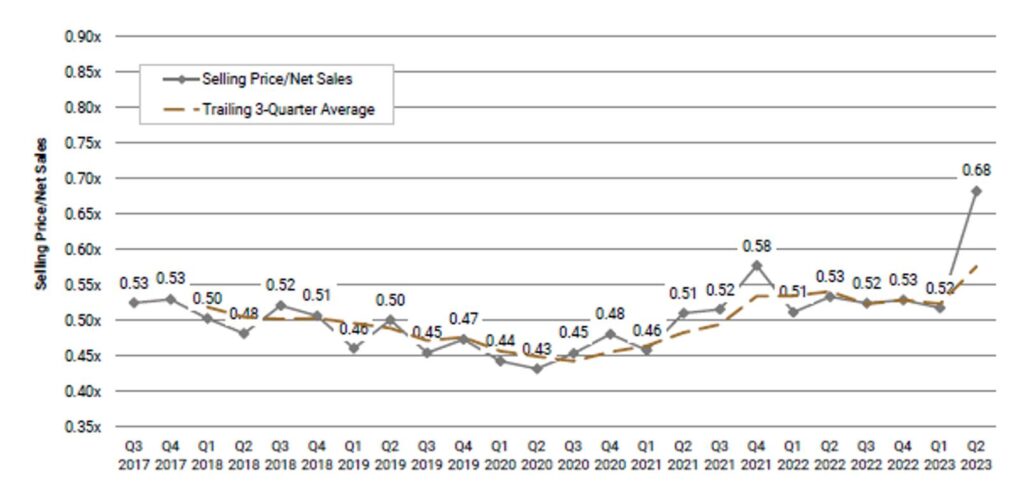

Median selling price per net sales for private companies saw an uptick from 0.52x in 2022 to 0.68x at Q2 2023. This contrasts 2022, as the median selling price per net sales decreased from 0.58x at Q4 2021 to ~0.53x throughout 2022.

The table below illustrates the median selling price per net sales for private companies:

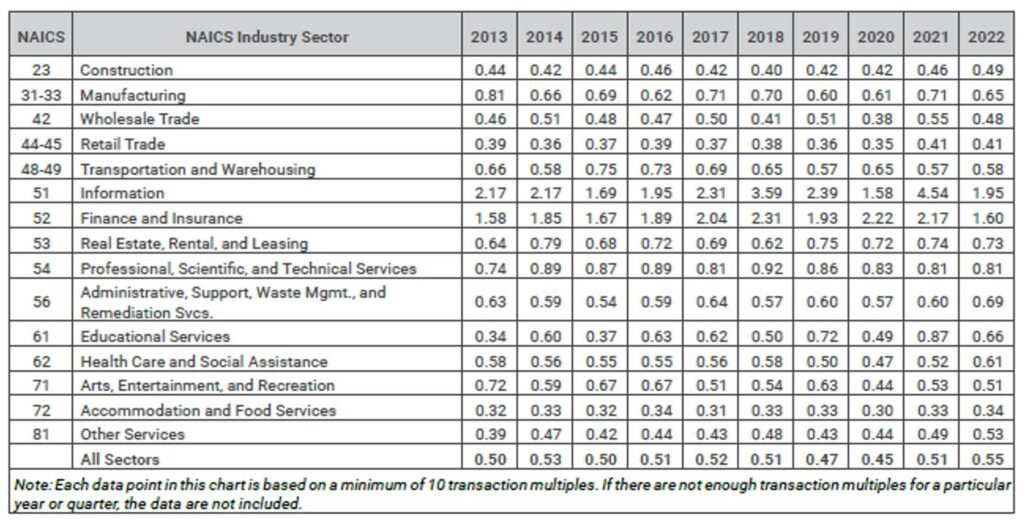

Median net sales multiples for private companies decreased in seven of the 15 industry sectors in 2022. Two sectors that saw notable declines were information and finance, which decreased a notable 57 percent and 26 percent, respectively.

The following table illustrates the median selling price per net sales by sector for private companies:

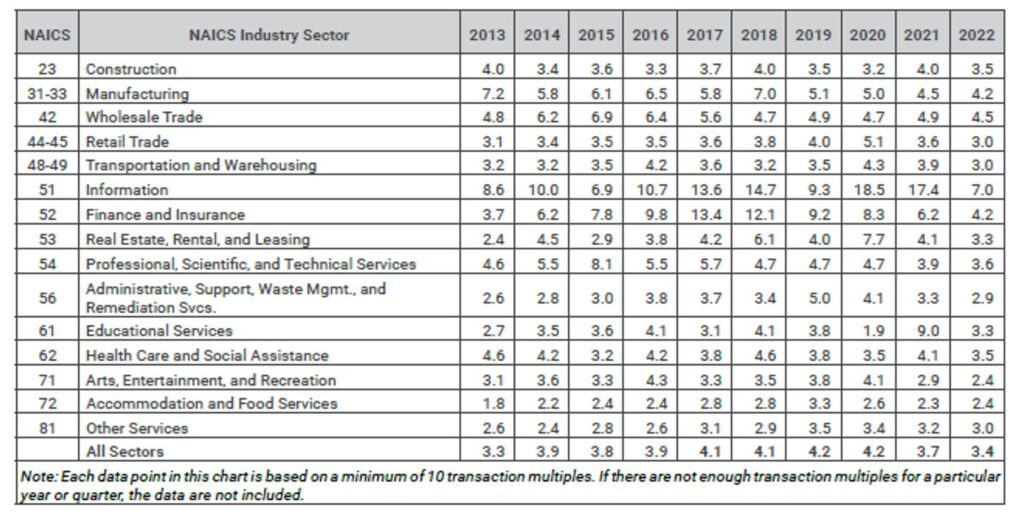

Median EBITDA multiples saw a decrease in all sectors in 2022, except for accommodations and food services. Notable decreases occurred in educational services and information, with decreases of 64 percent and 60 percent, respectively.

The following table illustrates the median selling price per EBITDA by sector for private companies:

While it remains impossible to predict an exact sale price for any given company, being informed about recent industry multiples can enhance your readiness for a successful transaction. Additionally, understanding your potential buyers and properly preparing your business for a transaction are essential considerations. If you have any questions or would like to learn more about this process, please contact us.

Michael Lipschutz is a manager with Kreischer Miller. Contact him at Email.