Does your construction company design or install energy-efficient buildings for government or tax-exempt entities? If so, did you know that your company may qualify for a special tax deduction, Section 179D, on these projects?

This article focuses on the application of Section 179D, including background and recent enhancements included in the Inflation Reduction Act (IRA) of 2022, as well as next steps to consider if you believe you may qualify.

What is Section 179D?

Section 179D offers a tax deduction for the design of energy-efficient commercial building property when constructing a new or improving an existing commercial building, government building, or tax-exempt entity building. Qualified property includes installation of interior lighting systems, HVAC systems, and the building envelope.

You are probably wondering, who can claim this deduction? In addition to the building owner, architects, engineers, and design-build contractors that work on new or renovated government-owned or tax-exempt entity owned buildings and structures can claim this deduction. Government-owned buildings consist of federal, state, or local government-owned buildings (including public schools), while tax-exempt entities consist of charitable organizations, churches, some private schools and universities, and other not-for-profits.

It is important to understand that in order to qualify for the deduction as a party other than the building owner, there must be involvement with the design of technical specifications related to the energy efficiency of property, rather than merely installing the property.

Recent Enhancements

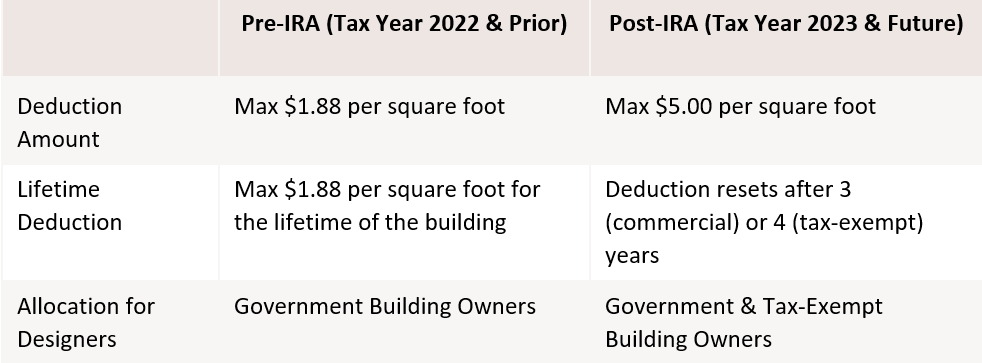

Section 179D initially provided a permanent deduction up to $1.88 per square foot for certain energy-saving commercial building properties. However, Section 179D was expanded as part of the IRA, which was signed into law on August 16, 2022. The expansion more than doubled the tax incentive, up to a maximum of $5.00 per square foot (before inflation adjustments). The maximum deductions are based on a sliding scale tied to energy efficiency gained, and prevailing wage and apprenticeship requirements.

The changes resulting from the IRA are worth revisiting, particularly for construction companies and engineers. We added the table below to highlight some noteworthy changes.

Next Steps to Claim the Deduction

If you think you may qualify, particularly as a party other than the building owner, we identified the next steps to ensure the deduction is valid and meets IRS stipulations.

Step #1: Obtain a Signed 179D Allocation Letter

Since tax-exempt entities receive no benefit from a tax deduction, the deduction can be allocated to the designer(s) of the energy efficient building/improvements. The allocation comes in the form of a signed allocation letter from the building owner. The allocation letter is an IRS mandate and is used to substantiate the amount of deduction allocated to the taxpayer. Components of an allocation letter should include a detailed project description, the name and contact information of all involved parties, and specific details on how the deduction will be allocated.

Step #2: Hire a Qualified Third Party to Certify the Deduction

A report certifying the Section 179D deduction will need to be prepared by a qualified third-party who uses IRS-approved energy software to review the energy performance of the building and improvements. This study is to be completed in the same year the building is placed in service.

Next Steps for Your Construction Company

Getting a head start on the steps above is crucial for ensuring the eligibility of the deduction and compliance with the IRS. Since the study, placed in service date, and tax return in which the deduction is reported fall within the same tax year, having these action items on your radar can help you stay organized to ensure you receive the highest tax incentive.

The Section 179D deduction can be a highly lucrative deduction for designers of energy efficient property, especially under the expanded IRA enhancements. If you think your business has eligible contracts and would like assistance with the process, please reach out to a member of Kreischer Miller’s Construction Industry Group as soon as possible.

Information contained in this alert should not be construed as the rendering of specific accounting, tax, or other advice. Material may become outdated and anyone using this should research and update to ensure accuracy. In no event will the publisher be liable for any damages, direct, indirect, or consequential, claimed to result from use of the material contained in this alert. Readers are encouraged to consult with their advisors before making any decisions.