Succession planning is one of the most critical aspects of running a family business, yet it remains an area where many companies fall short.

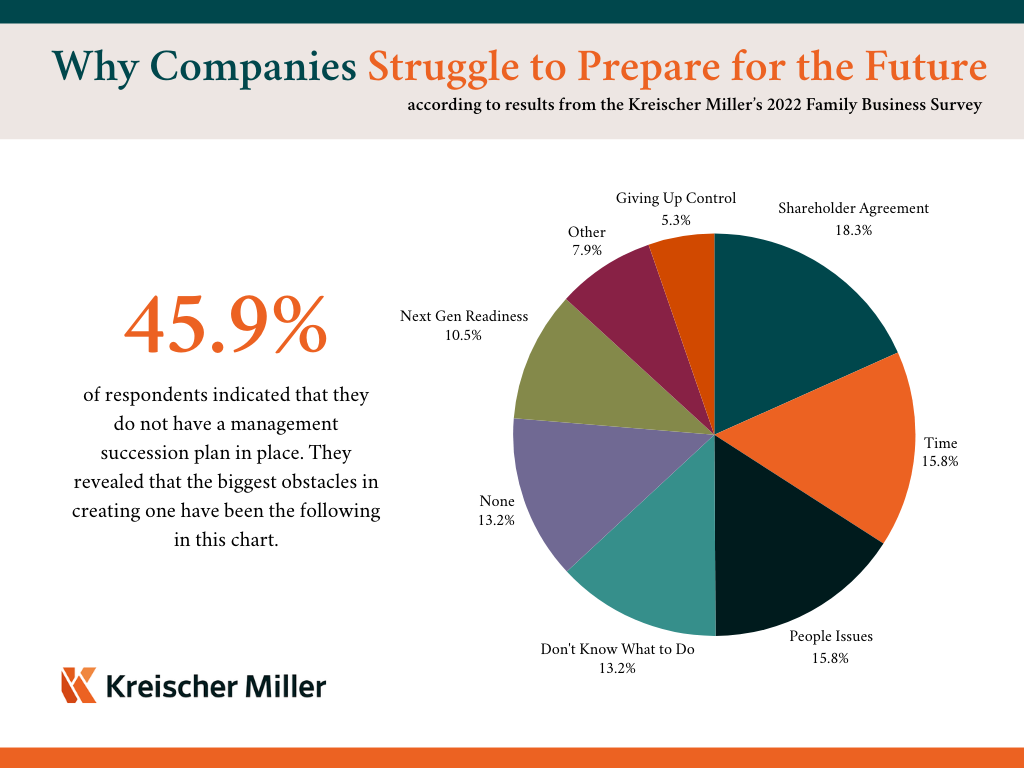

Despite knowing the importance of planning for your business’s future, 45.9 percent of family-owned companies still do not have a formal plan in place, according to the Kreischer Miller Family Business Survey. This statistic reveals a persistent challenge among family businesses: planning for continuity without disrupting operations or causing internal conflict.

But what exactly holds business owners back from executing on a succession plan? In this article, we’ll explore more statistics from our Family Business Survey and reveal why companies like these often struggle to prepare for the future.

1. Complex Shareholder Agreements (18.3%)

One of the biggest barriers to succession planning is navigating shareholder agreement to get everyone on the same page, particularly when multiple family members are involved. Family dynamics can be challenging, particularly when family ownership extends to both family member working in the business and those that are passive investors. The variety of perspectives and goals can be difficult when needing to come to an agreeance about next steps.

For example, some agreements restrict who can hold ownership stakes, which can complicate leadership transitions if a chosen successor is not already a shareholder. Others require unanimous approval from all stakeholders before leadership changes can occur, leading to delays or disputes. If these agreements are not updated regularly, they can become major roadblocks to effective succession planning.

2. Time Constraints and Day-to-Day Pressures (15.8%)

For many family business owners, immediate business operations take priority over long-term planning. They are deeply involved in the day-to-day running of the company — managing clients, employees, financials, and growth strategies — leaving little time to focus on succession.

Additionally, succession planning is often seen as something that can be handled "later," especially if the current leadership is still relatively young and healthy. However, this mindset can backfire if unexpected events, such as illness or economic downturns, force an unplanned transition. Without a structured plan in place, the business may struggle to respond effectively.

3. People Issues and Family Dynamics (15.8%)

Family-run businesses are unique in that professional and personal relationships are deeply intertwined. This makes succession planning not just a business decision, but an emotional one. Some of the most common issues include:

- Sibling rivalries: If multiple children or family members are vying for leadership, choosing one over the others can cause friction.

- Different visions for the company: The next generation may have a different outlook on the business, creating tension between outgoing and incoming leaders.

- Unwillingness to retire: Many founders struggle to let go of control, even when it’s time to transition. Some fear that stepping back will result in a loss of identity or purpose.

These interpersonal challenges can delay or derail succession discussions, especially if there is no structured process for handling them.

4. Lack of Knowledge or Clear Direction (13.2%)

Many family business owners acknowledge the need for succession planning but don’t know where to start. Unlike larger corporations, which often have HR departments and legal teams to handle executive transitions, family-run companies typically lack formal guidance on:

- How to select and groom the next leader.

- Whether leadership should stay within the family or be passed to a non-family executive.

- The financial and tax implications of transitioning ownership.

This uncertainty leads to inaction, as owners avoid the topic rather than risk making the wrong decision.

5. Concerns About Next-Generation Readiness (10.5%)

A major concern among family business owners is whether the next generation is prepared and capable of running the company. The survey found that only 39 percent of businesses have a formal development plan for future leaders, meaning that most family businesses are not actively investing in their successors’ growth.

Some common challenges include:

- Lack of interest from the next generation: Not all family members want to take over the business, which can leave a leadership gap.

- Limited real-world experience: Many younger family members have only worked within the family business and may lack outside industry knowledge or work experience.

- No formal training programs: Without structured mentorship, executive coaching, or educational initiatives, potential successors may struggle to develop the skills needed for leadership.

If owners do not feel confident in the next generation’s ability to lead, they often postpone planning — sometimes until it’s too late.

6. Fear of Losing Control (5.3%)

For many business owners, the company is their legacy and letting go is an emotional process. Some worry that transitioning leadership will mean losing their influence, while others fear that successors will make changes they don’t agree with.

As a result, some owners avoid discussing succession altogether, either delaying decisions indefinitely or assuming they will remain involved indefinitely. However, without a structured transition plan, this approach can create confusion and instability for both the family and the business.

Break the Cycle & Overcome These Challenges with Kreischer Miller

Despite these barriers, succession planning is not an impossible task. It requires proactive effort, open communication, and, in many cases, external guidance. Businesses that take the time to address these challenges head-on will be better positioned for long-term success.

By recognizing these common roadblocks and implementing strategies to overcome them, family businesses can ensure a smooth leadership transition—preserving both their legacy and their financial future.

Explore our Family Business Planning Services or Transition & Exit Planning Strategies today.