Employee stock ownership plans (ESOPs) are retirement plans in which a company contributes its stock or money to buy its own stock, which is held in a trust for the benefit of the company's employees.

ESOPs can be extremely beneficial for employees looking to have a stake in a company’s long-term success and profitability or for seeking retirement savings benefits. These stock ownership plans are also tax-deductible and can provide potential tax perks.

But while ESOP plans can be mutually advantageous for both employees and the company, businesses that offer these plans must fulfill certain compliance requirements.

The Internal Revenue Service (IRS) and other regulatory bodies such as the Department of Labor (DOL) require businesses to adhere to their ESOP requirements — and some businesses may even be required to undergo an annual ESOP audit.

Let’s discuss the requirements to help you see if your business needs to engage in an audit for your employee stock ownership plan.

Does the DOL require an ESOP audit?

ESOP audits ensure that stock plans for employees comply with regulatory requirements and accurately represent the financial status of the plan. Despite these assessments being beneficial, the DOL does not explicitly require all ESOPs to undergo an audit.

Requirements and Rules Based on The Size of Plan & Number of Participants

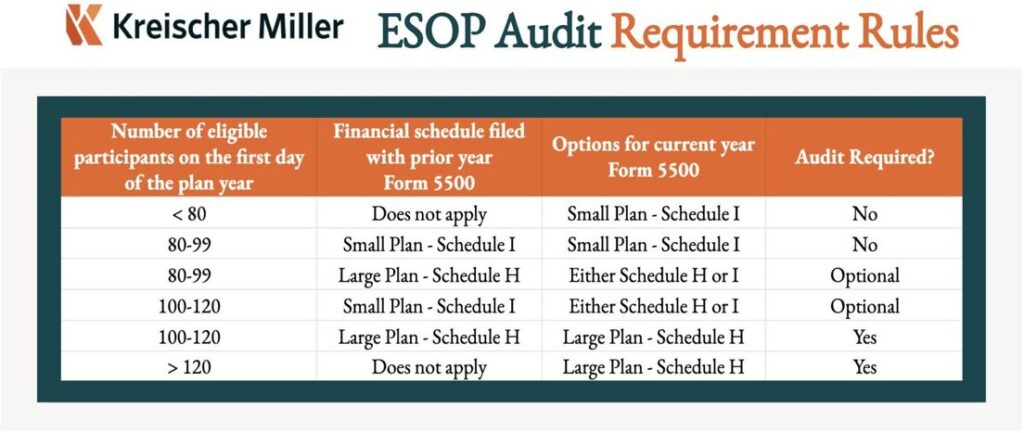

Whether an audit is required is dependent on how many employees are participating in your ESOP plan. That’s because the audit requirement is determined based on the number of eligible participants reported on the Form 5500 filing as of the beginning of the plan year.

Managing your ESOP participant count is essential in determining whether there is an audit requirement, but it is often confusing to plan sponsors.

The table below illustrates the requirement rules based on the number of eligible participants at the beginning of the year.

What is considered an “eligible participant?”

The counting methodology for ESOPs is based on the number of participants with account balances as of the beginning of the plan year.

Generally, ESOPs with 100 or more eligible participants are categorized as large plans and are required to attach audited financial statements to their Form 5500 filing. However, the 100 number only applies to ESOPs in their initial year of existence. Plans that have existed for more than one year are subject to certain exceptions, commonly referred to as the 80-120 rule.

ESOPs with more than 120 eligible participants at the beginning of the plan year are automatically subject to the audit requirement with no applicable exceptions.

ESOPs with fewer than 100 participants are exempt from the DOL audit requirement unless the plan trustee requests an audit.

If a plan exceeded 120 participants in the prior year but currently has between 100-120 eligible participants, an audit would be required until the eligible participant count falls below 100.

On the contrary, if the number of eligible participants was under 100 in the prior year, an audit would not be required until the number of eligible participants exceeds 120.

Determining Your Business’s ESOP Audit Requirements

How do you know for sure if your business is compliant with federal and regulatory ESOP requirements?

Businesses often consult with legal and financial professionals to understand their specific audit requirements and ensure compliance with applicable regulations.

When is the best time to conduct an ESOP audit?

We’re often asked which time of year is best to determine whether your business needs an annual ESOP audit for the next plan year.

Plan sponsors will need to obtain a valuation of the company’s stock soon after fiscal year-end to provide the auditors with enough time to complete the audit within regulatory deadlines.

Plan sponsors often need assistance with determining the eligible participant count and whether an audit is required. Working with plan recordkeepers and your audit firm is important to identify the requirement in advance and properly complete the audit promptly.

Specialized Audit Requirement Services for ESOPs with Kreischer Miller

We regularly work with businesses to assist with the audit determination and discuss best practices to stay ahead of the audit requirement.

From Compliance with Section 409(p), DOL, and ERISA requirements to financial due diligence — including Quality of Earnings analysis — we’re an independent auditing firm with expertise in employee benefit plans and regulatory compliance offering a number of ESOP auditing services. Contact our specialists for help determining your employee stock ownership plan audit requirements and more, today.