In the world of mergers and acquisitions (M&A), net working capital often becomes a major pain point, especially as deals get closer to closing.

Both buyers and sellers put a lot of effort into negotiating the main terms of the deal, but details of the net working capital adjustment often get pushed aside, causing last-minute stress.

Even though this negotiation is crucial, it can create a lot of tension, as it tends to be a difficult and somewhat obscure element in the transaction process. Because of its complexity — and sometimes the buyer and seller’s lack of understanding — the net working capital aspect seems to be placed on the back burner to be agreed upon later.

That’s why we want to discuss what net working capital is when used in a business sale. This is especially helpful for mid-sized business owners who do not go through M&A deals very often and might find this part of the process particularly confusing.

What is Working Capital?

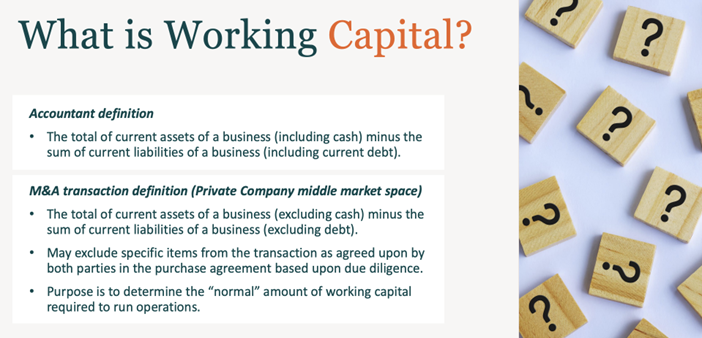

Part of the confusion around the concept of working capital is that not everyone understands the definition as it pertains to the M&A space. If we were talking to the everyday accountant, they may bring up the traditional accounting definition of working capital. An accountant may define working capital as the total of current assets of a business (including cash) minus the sum of current liabilities of a business (including current debt). They would also tend to go off the reported numbers on the balance sheet.

For accounting purposes alone, this is accurate. But for M&A transactions — especially in the private company middle market space — we know that reported working capital and the net working capital for M&A can be very different.

How Does Working Capital Apply to M&A Transactions?

There are differences in how working capital is defined in the M&A space. For example, net working capital for M&A deals in the private company space generally excludes cash and excludes debt from working capital.

How Cash Is Treated Differently

Cash is generally excluded as most privately held companies consider their bank accounts an extension of their personal savings. Or, they may keep excess cash or working capital in reserves within their business. Therefore, cash balances maintained in privately held companies are sometimes subjective and do not always reflect the underlying needs for operating the business.

How Debt Is Treated Differently

Similar to cash, debt is omitted because buyers will establish their own financing resources to be used in the purchase of the business and to provide for their own working capital needs.

This means that these items will not be purchased by the buyer and should not be factored into when determining the appropriate level of working capital that should be delivered on the date the transaction is intended to close.

In addition, it's also very common for items to be identified during due diligence which may impact the reported balances of the accounts included in working capital balances. These adjustments should also be factored into determining the appropriate level of working capital a business should hold.

How M&A Companies Define Net Working Capital

When considering these two differences, the private company middle market M&A transaction definition of net working capital would be more accurately described as the following: the total of current assets of a business (excluding cash) minus the sum of current liabilities of a business (excluding debt).

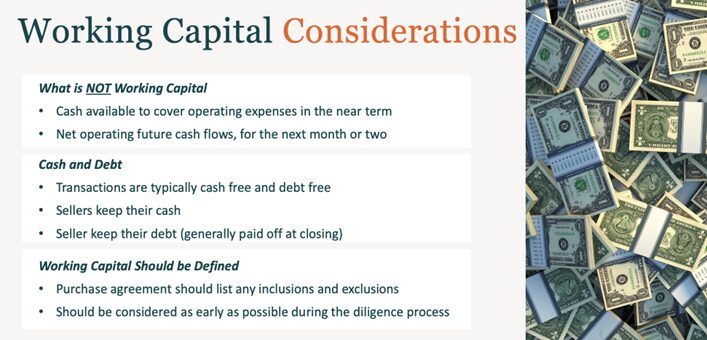

What Working Capital Is Not

Sometimes working capital is only thought of as payroll: to cover payroll for a certain period of time and to cover certain operating expenses over the next month. Business owners may think, “Let's just leave enough working capital in there to cover that, which could be in cash.”

However, working capital is not just payroll and operating expenses. It's not just the short-term cash flows going in and out of the business working capital. It is more of a balance sheet measurement. In a transaction, it's the balance sheet of what the appropriate working capital is.

The purpose of examining working capital in an M&A transaction is to determine the appropriate level of working capital that should be present in the business when the seller hands the business off to the buyer. The buyer should expect to have sufficient working capital assets (receivables and inventory) less the appropriate level of working capital liabilities (payables and payroll liabilities) on the day they take ownership, so they can assume normal operations on day one.

An Analogy for Working Capital in M&A: Selling a Car

For instance, think about working capital in the scenario of you buying a used car. You and the seller agree on the purchase price of that car and how it's going to function. You may even agree that when you buy this car, it will include a half tank of gas, which in this case would represent the working capital. You close on to purchase the car and take the keys from the seller. You start to drive away and you barely get a mile down the road and the car sputters and rolls to a stop because you realize you just purchased the car with no gas in the tank.

Working capital for M&A is very similar when a buyer wants to take over a business. You want to ensure there is sufficient or normal level of net working capital on Day One to generate cash flows and continue to support operations post-close.

Despite how working capital is measured for purposes of a potential transaction, working capital has to be clearly defined in the purchase agreement, whether it's a stock purchase agreement (SPA) or an asset purchase agreement (APA).

An Example of How Working Capital is Determined

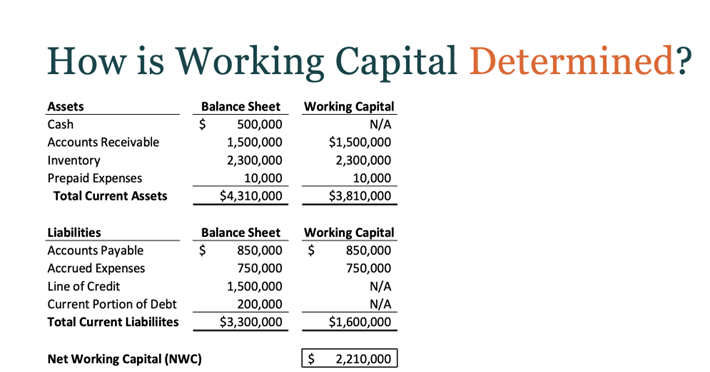

This example assumes there are no diligence adjustments. It takes the numbers from the reported balance sheet as the starting point.

The reported balance sheet shown above has roughly $4.3 million of current assets. However, as we discussed previously, working capital in the private M&A space generally excludes cash. So, the current assets are actually only $3.8 million. The same thing applies to current liabilities.

The reported balance sheet shows $3.3 million on the balance sheet. Once again, debt is excluded primarily from these transactions. So, our current liabilities for working capital purposes are only $1.6 million. In this simple example, the net working capital amount based on the reported numbers would be $2.2 million. This is assuming the deal is on a cash-free, debt-free basis. It's your accounts receivable inventory (ARI), your current assets, and your current liabilities. The buyer would shake hands and agree, “You need to leave me $2.2 million of working capital in the business.”

Watch the Full Working Capital Webinar to Learn More

In conclusion, we see that there are different definitions of net working capital that exist. One thing that remains true for M&A specifically is that net working capital should be defined and considered early in the due diligence process.

Defining net working capital in mergers and acquisitions is just one topic covered in our full webinar, Net Working Capital in M&A Transactions.

Watch the full recording to learn more about:

- Ways that working capital is measured and determined

- Why working capital is important to buyers and sellers from a financial standpoint

- Illustrations of different working capital scenarios

For questions about managing your M&A working capital, explore our Transaction Advisory Services and reach out today.