Acquiring a business can impact your growth dramatically and quickly. Before you make a significant investment, it is prudent to perform due diligence on the target company and its operations. How much is enough due diligence? The level of work ranges from high level discussions to in-depth studies with detailed analyses taking months to complete.

If your company is a serial acquirer, you would be well served to have a process that allows the risk associated with each potential transaction to be measured. The results of that process can be turned into a risk score that guides the amount of work done. The risk assessment process should be tailored to your business and the current environment. Rather than make it a complicated calculation, you can identify areas to consider and score each at a high, medium, or low risk for the transaction. If one area has more potential risk or benefit, you can weight it more heavily in your overall score.

For instance, a target company with one line of business just like yours has lower risk than one with multiple product lines or services and/or multiple locations. A target that provides you clean, clear financial information tied to audited statements has less risk than the target whose numbers appear to be cobbled together from several systems and change every time you look at them. An asset deal has less risk than the purchase of a company’s stock. A transaction that you finance internally has less risk than one for which you require bank debt.

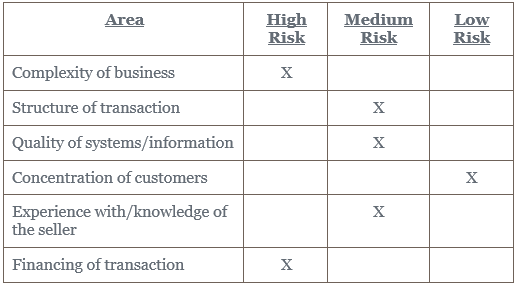

Following is an example score chart:

The scores are 15 points for each high risk, 10 for medium, and 5 for low. In this example, the target company would score 65. On average, that is slightly above a medium risk.

The buyer determines the scope of work to be completed for each risk level. Perhaps the low risk acquisitions can be addressed only with internal resources and limited procedures. Medium risk acquisitions would involve outside advisors to perform only certain procedures, while internal team members perform the remainder of procedures. High risk transactions would require full due diligence procedures performed by outside resources. The individual procedures to be performed are tailored based on the risk scoring above and the business to be analyzed.

Knowing your business and the stakeholders involved, you can create a simple risk scoring process. The value in the process is to be intentional in determining how much due diligence to conduct and what expertise you need from outside of your business. There are diminishing returns from making the risk scoring too complicated, so it is best to dive in and devise a simple framework.

To learn more, you can contact Jennifer L. Kreischer at Email or 215.441.4600.

You may also like: