With the worst of the global pandemic behind us (hopefully), some privately-held business owners are reevaluating their desire to continue as owner-operators and are entertaining retirement options. This is particularly true for baby-boomers who postponed their retirement as a result of the COVID-19 pandemic. In some of these cases, owner-operators have no interest in being an ongoing owner in a company where they are no longer involved in the day-to-day operations. As a result, merger and acquisition activity has heated up with more and more businesses on the market.

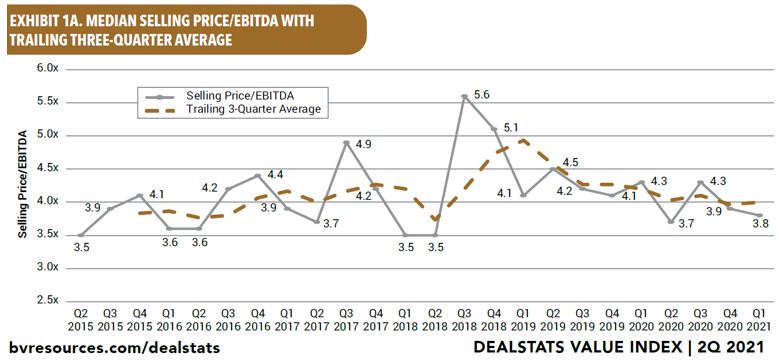

Despite the significant amount of investor capital sitting around looking for a home, transaction multiples have not been increasing. According to the DealStats Value Index below (provided by Business Valuation Resources, LLC), the selling prices as a multiple of Earnings Before Interest Taxes Depreciation and Amortization (EBITDA) have been trending downward. This can be attributed to the increase in supply of investment opportunities, whereas demand has held relatively steady.

This does not mean that owners should hold off on selling if now is the right time for them. Rather, owners should look to outpace market multiples by reducing the perceived risk that an outside investor may associate with the business and its future cash flows. Reducing perceived risk is synonymous with increasing business valuation drivers and makes businesses more attractive to buyers. The less risky a business and its associated cash flows are, the more likely a buyer will be willing to pay a premium over market multiples. Business owners must be conscious of this and look at their business in the same manner that a potential buyer would view their future investment, which may be very different than their own paradigm.

Below are five common valuation drivers related to mid-sized businesses, which tend to be hot spots for potential buyers:

- Owner involvement and depth of management team – A business with a management team dominated by an owner(s) may be the biggest risk in the eyes of an investor. It is not unheard of for an owner to be the CEO, top salesperson, and head of operations. Upon their retirement, the profitability of the company could be drastically impacted. As counterintuitive as it may seem, spending more to bring in a management team a couple of years before a transition may be the better financial decision in the long run.

- Product, service, and geographic expansion – Businesses that are “one trick ponies” are inherently riskier. The same can be said for companies that serve a narrow customer base, both in terms of business type and geographies. Strategically, businesses leaders should always be exploring new ways to increase revenues, including production and market expansion.

- Concentrations of risk – Along the same lines as expanding product and service offerings, concentration of risk (as the name implies) increases risks. Putting all your eggs in one basket, whether it’s a supplier, customer, vendor, contractor, or employee(s), could create complications if the respective relationship becomes damaged.

- Branding and marketing – Businesses that have developed a strong brand are more valuable. The intangible value from branding commands a higher price tag than value generated solely by equipment or services (tangible value). Investing in marketing efforts can certainly be worth it but may take time to reap its returns.

- Quality of financial records – In the current environment, it is commonplace for business transactions to be subject to due diligence and quality of earnings analysis. Such procedures provide assurance to the buyer that the seller’s financial assertions are accurate. The better the financial records, the smoother the transaction will proceed and the more confidence the buyer will have in their future investment.

When preparing your business for a sale, it is wise to evaluate the business for real or perceived risks. Having an outside third party evaluate the business valuation drivers impacting your business and perform light due diligence could provide insight which may not be apparent from an inside view. Nevertheless, being proactive and getting your business ready for sale will enable a business owner to have a hand in increasing the transaction value.

If you would like to discuss preparing your business for an ownership transition, please contact your Kreischer Miller relationship professional or any member of our team. Business valuation services are one of our specialty areas which we offer to our clients as part of our business advisory practice.

Brian J. Sharkey can be reached at Email or 215.441.4600.

You may also like: