The 2022 midterm elections are quickly approaching, and the country will turn its attention to the 2024 Presidential election cycle shortly thereafter. Over the next two years, these elections will impact every level of government from the President of the United States down to local offices in every town. If charitable organizations don’t understand the differences between “Political Activity” and “Lobbying Activity,” they can easily blur these lines and find their organization in trouble with the IRS. This article will try to unblur these lines and discuss the allowable extent an organization is permitted to participate in lobbying activities.

In order to begin to understand which allowable lobbying activities a 501(c)(3) public charity can be involved in and the IRS approved limits, you must first know the differences between “Political Campaign Activities” and “Lobbying Activities” so that these activities can be tracked separately by the organization.

The Internal Revenue Code defines Political Campaign Activity or “Electioneering” as “directly or indirectly participating in, or intervening in, any political campaign on behalf of (or in opposition to) any candidate for elective public office.” These rules also require organizations to remain nonpartisan. Under the “Johnson Amendment,” all 501(c)(3) not-for-profit organizations are prohibited from engaging in the act of electioneering. For a deeper understanding of Political Campaign Restrictions, please see our recent Tax Alert.

Public charities, however, are permitted to perform lobbying activities, which is the attempt to influence legislation. However, the IRS has dictated spending limits for these activities and exceeding these limits can result in financial penalties on the organization. In severe circumstances, the IRS can even revoke the organization’s exemption.

These limits are determined through one of the following two methods:

- Substantial Part Test: Instead of setting a hard limit or imposing an absolute ban on all lobbying activities by charitable not-for-profits, the IRS stated in 1934 that, “no substantial part of the activities” may be for “carrying on propaganda, or otherwise attempting, to influence legislation.” This language allowed organizations to engage in lobbying activities but left a lot to the imagination as to what the IRS meant by “no substantial part.” To date, the IRS has never clearly defined this language. History in this area teaches us that the IRS weighs the facts and circumstances of each case as well as the organization’s spending. This Substantial Part Test leaves many organizations uneasy and turning to the Expenditure Test to make a 501h election.

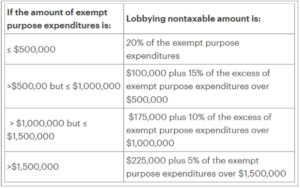

- Expenditure Test: The Expenditure Test is the most effective way for an organization to specifically know its lobbying limits. In order to utilize this test, the organization would have to make a 501h election by filing Form 5786 with the IRS. The limits are then based on a percentage of the exempt purpose expenditures for any given period of time and cannot exceed $1,000,000. As noted by the IRS, “Under the expenditure test, the extent of an organization’s lobbying activity will not jeopardize its tax-exempt status, provided its expenditures, related to such activity, do not normally exceed an amount specified in section 4911. This limit is generally based upon the size of the organization and may not exceed $1,000,000, as indicated in the table below.”

The IRS also differentiates between “Grassroots” and “Direct” lobbying expenditures when applying limits to spending. Direct lobbying expenditures are those that “attempt to influence any legislation through communication” with government officials of the general public in a “referendum, initiative, constitutional amendment, or similar.” Grassroots lobbying activities are any activities that try “to affect the opinions of the general public or any part of the general public.” Grassroots lobbying activities are limited to 25 percent of the organization’s total lobbying expenditures.

If the organization exceeds these limits, an excise tax of 25 percent will be applied to the excess amount spent on lobbying in any given year. The organization could lose its exemption if it engages in excessive lobbying activities over a four-year period. However, the benefit of this test is that the organization understands the limits and can adjust spending accordingly, unlike the Substantial Part Test which is arbitrary and up to the IRS’s discretion upon review. Due to the limits that the 501h election puts into place, this method may not be the best option for large organizations that have higher spending thresholds.

A charitable organization’s decision to become involved in lobbying activities is significant and requires proper planning to ensure that the organization is protected. Consultations with legal counsel and your accountants is highly recommended before beginning any new lobbying initiatives.

Christopher Pekula can be reached at Email or 215.441.4600.

You may also like: