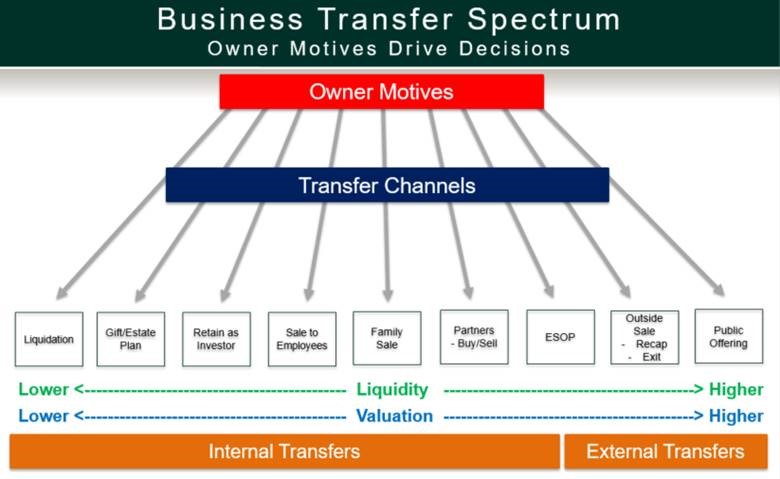

One of the classic mistakes that private company owners often make when transferring ownership of their company is not fully exploring all their options. To do this properly requires thoughtful advance planning and analysis, because there are many options available as you can see in the business transfer model below.

Many owners do not take the extra step to proactively seek proper advice in exploring all their options, but it is a good idea to do so. Not only are these options complex, but the decisions are very weighty because they affect many people including the owner, the family, and the employees. What also makes it difficult is that most owners have more than one goal for their business transfer. Financial considerations are always part of this discussion, but many owners also want to secure the legacy of the business, protect their employees’ jobs, and continue to contribute to their local community.

Achieving multiple goals involves tradeoffs that can affect the valuation of the company, the structure of the transaction, and the level of liquidity. Make sure you understand all of the potential implications as you consider your options. Each transfer option can be modeled so you can better understand the tradeoffs involved with each approach.

While many businesses choose to ignore this in-depth planning and analysis, they do so at their own peril. A transition of every company’s ownership has to happen at some point – whether planned for or not – because time ticks on and our mortality will eventually bear on the situation. Proactively addressing your situation or doing nothing are both decisions that have consequences. But we are finding that for the companies that choose the “do nothing” route, the consequences are more dire.

As a result, we have changed our business transfer model to include another transfer channel – liquidation. This is usually the only choice available for those who chose the “do nothing” decision. Be forewarned, though, that going this route will garner the lowest value for your business since it requires the sale of the company’s assets at fire sale prices.

We advise you to invest the time to think through your transfer motives, understand the details of each of the transfer options, and identify where they intersect. Being proactive in planning your transition will help you understand how best to achieve your goals and avoid the de facto choice – liquidation.

Mario O. Vicari is a director with Kreischer Miller and a specialist for the Center for Private Company Excellence. Contact him at Email.

You may also like: